Ripple-Backed Evernorth to Raise $1B and Boost XRP Value

Ripple-backed Evernorth plans a $1B IPO to expand its blockchain ecosystem, attract major investors, and boost XRP’s long-term growth potential in global markets.

By Yaser | Published on October 20, 2025

The Deal — What Evernorth Announced and Why It Matters

Evernorth announced it will list on Nasdaq via a SPAC merger and is expected to raise over $1 billion in gross proceeds. That capital, according to company statements and reporting, will be used in part to accumulate XRP as a core treasury asset — a move that directly links public-equity capital flows to demand for a major cryptocurrency. This matters because it creates a visible, regulated vehicle that can funnel institutional cash into XRP holdings; that could change how institutions view and allocate to digital assets. The announcement also names strategic backers and signals a push to normalize XRP inside more traditional financial structures.

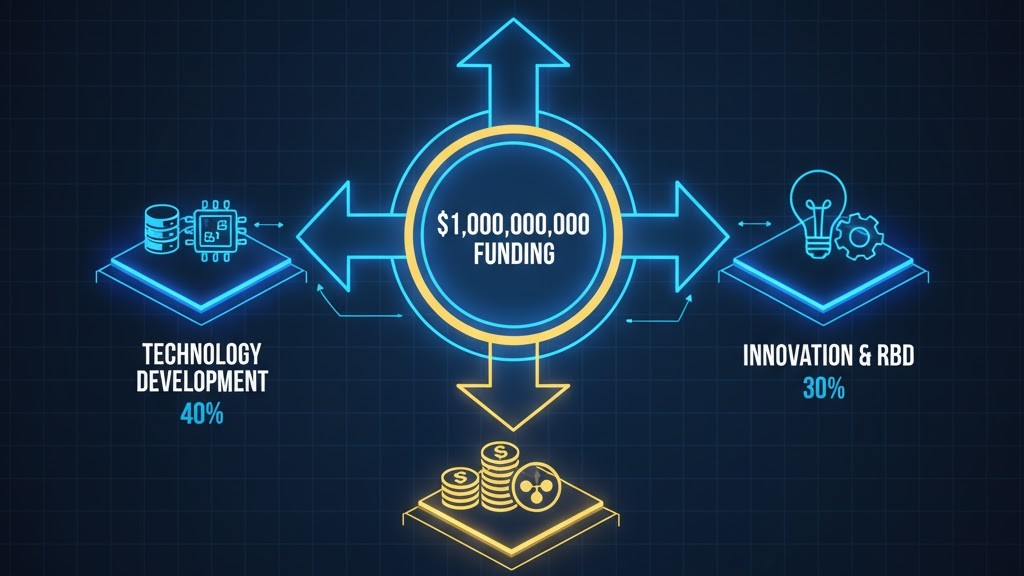

What the $1B figure actually means for market capacity

Raising over $1 billion creates scale: it gives Evernorth purchasing power to buy significant XRP positions without constantly distorting small markets. In practice, the firm can dollar-cost-average purchases, negotiate OTC block trades, and build a sizeable treasury without immediate price shocks — though large buys still influence liquidity and short-term volatility.

Who’s backing the move and why that matters

Investors named in reporting include SBI (committing $200M), Pantera Capital, Kraken and others. Having known institutional and strategic partners increases credibility and signals to other investors that Evernorth is not a lone retail play. This institutional backing can accelerate acceptance among cautious money managers.

Why a public, regulated vehicle is different from private accumulation

A Nasdaq-listed treasury company operates under public-market scrutiny and disclosure rules. That transparency may attract capital that avoids opaque private crypto accumulation. Consequently, Evernorth’s strategy may open a new channel for mainstream capital to build long-term positions in XRP under a regulated equity wrapper.

Immediate Market Reactions — Price, Volume and Sentiment Signals

Markets typically react quickly to capital/institutional moves. Within hours of the announcement, XRP’s price and trading volume showed upward momentum as traders priced in potential demand. Short-term trading desks and algos pick up this type of news and reweight order books. At the same time, social sentiment and analyst notes spike; headlines that tie a token to a billion-dollar vehicle increase retail interest and algorithmic flows. Use these short-term signals for timing, but be cautious: initial spikes can retrace once buying pace stabilizes.

What traders saw in the first 24 hours

Traders watched for exchange inflows/outflows, block trade reports, and OTC indications. Quick on-chain checks often show whether whales or funds are moving tokens into custody. Those on-chain patterns help separate short-term speculation from sustained accumulation.

Volume vs. price — why both matter

High volume with modest price movement suggests deeper liquidity and possibly coordinated large buys. Conversely, big price jumps on thin volume often indicate overreaction and higher short-term reversal risk. Watch both metrics when deciding entries.

Sentiment and narrative — the “official story” effect

When a token is tied to a public equity vehicle, the narrative shifts from speculative to institutional adoption. That narrative can sustain higher valuations if it leads to recurring buy programs or ETFs, but narrative alone does not guarantee long-term price strength.

Institutional Demand — How Evernorth Could Change Buy-Side Behavior

Institutional investors often prefer regulated exposure. A Nasdaq-listed firm buying XRP could make it easier for pension funds, family offices, and asset managers to gain indirect crypto exposure via equity purchases rather than direct token custody. This shift reduces custody friction, KYC/AML concerns, and internal policy barriers for some institutions. As a result, Evernorth may act as a bridge for capital that historically avoided direct crypto holdings.

Equity wrappers vs. direct token buys — pros and cons for institutions

Equity wrappers provide familiar governance, reporting, and legal recourse, but they dilute pure token exposure and may trade at equity-market multiples. Institutions weigh compliance and access benefits against these differences.

How custody and compliance fears fade with regulated vehicles

Many institutions cite custody risk as a core reason to avoid tokens. A public firm with audited practices and regulated disclosure reduces that concern, making allocation committees more likely to approve exposure.

Possible institutional allocation scenarios

Some institutions may buy Evernorth stock as a proxy for XRP exposure; others will prefer direct token purchases alongside the equity exposure. Expect a mixed model at first, with more direct allocations as custody and regulatory clarity improves.

Liquidity, Market Structure and Potential Side Effects

Large, coordinated treasury buys can improve market depth over time, but they can also create dependency. If Evernorth becomes a dominant buyer, XRP’s price action may increasingly follow the firm’s purchase cadence. That concentration risk can create a fragile market structure: good for early appreciation if buying continues, but risky if the firm halts purchases or decides to sell. Regulators and exchanges will watch for market manipulation concerns, and traders should account for the concentration effect in position sizing.

Concentration risk — what to watch for

Track the share of on-chain flows attributable to the treasury (when public) and monitor exchange reserves. Sudden increases in treasury ownership share raise concentration flags.

Liquidity improvements vs. single-actor dependence

While deeper order books reduce slippage for most traders, dependence on a single buyer to provide demand is a stability risk. Broader institutional participation reduces this single-point risk.

Regulatory scrutiny and fair-market concerns

Regulators may demand disclosures and guardrails if a public firm’s actions materially move markets. Expect more reporting and possible limits to how treasury capital is deployed, especially if price swings are extreme.

Strategic Moves — What Evernorth Might Actually Do with the Funds

Based on statements and reporting, Evernorth plans not only to accumulate XRP but also to pursue acquisitions and build an investment team. Possible strategic uses include purchasing large XRP blocks, funding infrastructure (custody, compliance), or acquiring startups that expand XRP utility. Each move changes how the market values both XRP and Evernorth equity: acquisitions or product launches that increase token utility are bullish; consolidation of holdings without clear utility could trigger regulatory questions or investor skepticism.

Buying strategy possibilities — DCA, OTC, or programmatic purchases

Evernorth could use dollar-cost averaging (DCA) to avoid one-off shocks, negotiate OTC purchases to save fees, or use algorithmic buys tied to market conditions. Each approach has trade-offs in price impact and signaling.

Acquisitions and partnerships — expanding the thesis

Acquiring fintech or blockchain firms that build on XRP (payments rails, settlement tools) strengthens the long-term thesis by increasing on-chain utility and demand.

Building infrastructure — custody, staking, or product labs

Evernorth can invest in custody solutions, compliance tooling, or developer grants. Such investments reduce frictions for other institutions and can indirectly boost token demand.

Risks to Watch — What Could Go Wrong for XRP and Evernorth

Despite promise, many risks exist: market volatility, policy shifts, failed pilots, or a change in investor sentiment. If the public market values Evernorth poorly, it may struggle to raise the planned capital or be pressured to sell holdings. Additionally, geopolitical, regulatory or macro shocks (credit events, liquidity crunches) could force the firm to alter its strategy. Finally, concentration of holdings can invite activist scrutiny or regulatory intervention if market fairness is questioned. Plan for these scenarios with strict risk-management rules.

Funding and market-timing risks

If the SPAC or IPO markets cool, the raise may be trimmed or delayed. That timing risk can change purchase plans and market expectations.

Legal and compliance uncertainty

While recent legal clarity helped Ripple, future regulatory shifts could change institutional appetite. Ongoing compliance burdens increase operating cost and execution risk.

Reputation and execution risks

Failure to integrate acquisitions or to safely custody tokens can damage trust. For a treasury model, execution excellence matters more than narrative.

What Traders and Investors Should Do Now — Practical Checklist

If you trade or invest around this news, follow a checklist: (1) Verify facts from primary reports (e.g., regulatory filings and company releases). (2) Watch on-chain flows and exchange reserves to detect real accumulation. (3) Set position limits to account for concentration and volatility. (4) Use staged entries (DCA) rather than lump-sum buys. (5) Monitor official Evernorth disclosures for exact purchase programs and timelines. These steps help you act rationally and reduce emotional trading after narrative-driven price moves.

Tools to use — how to monitor accumulation and flows

Use exchange reserve trackers, OTC desk reports, on-chain analytics (wallet clustering), and newswires like Reuters and Bloomberg to triangulate real buying activity.

Position sizing and stop rules for this event

Define max allocation and worst-case drawdown before adding exposure. Use stop limits or hedges for leveraged positions, and avoid over-leveraging into headline events.

Communication and tax considerations for equity vs token exposure

If you choose Evernorth equity, understand stock tax rules. If you buy token exposure, know token tax events. Equity and token investments have different reporting and custody requirements.

Longer-Term Outlook — Could This Re-Position XRP in the Market?

If Evernorth succeeds in raising and deploying >$1B into XRP with transparent, recurring purchase programs and utility-enhancing acquisitions, XRP could shift from a niche payments token to a mainstream institutionally-backed asset. That re-positioning would attract further funds, create deeper liquidity, and change narratives around XRP’s role in finance. Still, this is conditional: success depends on adoption, execution, and macro stability. For now, treat the development as a high-impact catalyst — one that deserves attention, but also measured exposure.

Scenario A — Success and wider institutional adoption

If pilots and purchases deliver value and the market treats Evernorth as a trusted steward, expect steady inflows and higher institutional interest across the board.

Scenario B — Partial success with episodic volatility

If purchases are intermittent or legal/regulatory friction emerges, XRP may experience episodic rallies and pullbacks, attracting traders but not long-term holders.

Scenario C — Failure to scale or regulatory pushback

If funding shortfalls, failed integrations, or regulatory actions occur, price and sentiment could reverse sharply. Always prepare for downside scenarios with clear exit rules.