Strong Bitcoin and Ethereum Rebound Signals Market Shift 2026

Bitcoin and Ethereum rebound as market sentiment improves, driven by renewed investor confidence and expectations of upcoming policy easing.

By Yaser | Published on November 28, 2025

Quick market roundup: what happened and why it matters

This week saw a noticeable rebound in major cryptocurrencies after a volatile stretch. Bitcoin reclaimed ground above the $90,000 area following deep intramonth losses, while Ethereum returned to the ~$3,000 neighborhood as traders digested macro cues and technical buying. The recovery has been driven by a mix of short-covering, dip-buying, and growing expectations that central bank policy will shift toward easing — a development that reduces the appeal of safe-haven cash and raises risk appetite. These moves matter because BTC and ETH often set the tone for the wider crypto market; when majors stabilize, altcoins and DeFi activity typically follow. For Grind News readers, tracking these first-order moves helps identify where real opportunities and real risks are reappearing in the market.

Short-covering and technical rebounds explained

Short positions built during the sell-off need to be closed when price reverses. That forced buying can accelerate rebounds even without fresh fundamental flows. Traders should watch volume and open interest metrics to judge whether a rebound is sustainable.

Macro cues driving sentiment

Expectations of near-term rate cuts and softer monetary policy have lifted risk assets broadly. Crypto responds strongly to these expectations because lower rates reduce the opportunity cost of holding volatile assets and can loosen liquidity.

Why readers should care now

Stabilization at major price levels creates better conditions for longer-term planning — for traders it means clearer ranges to work within; for investors it allows systematic re-entry plans; for builders it reduces short-term funding stress. Link this to your Grind Basics primer on market cycles and risk management.

Bitcoin’s technical picture: resistance, support and key levels to watch

Bitcoin’s rebound is meaningful but not decisive. The move back above $90,000 shows buyers are defending lower ranges, but on-chain data and orderbook clusters reveal nearby supply between roughly $93k–$96k and higher around $100k–$108k. These areas historically attract sell-side liquidity and can cap upside until they are absorbed. Traders should monitor momentum indicators and whether BTC can hold weekly support levels after the rebound. If BTC sustains above $90k with expanding volume, the next leg higher becomes more probable; otherwise, a retest of established support could occur. This technical context is essential for readers who plan entries or exits and for anyone tracking the macro-to-micro flow of crypto capital.

Immediate support and why it matters

Support near the $82k–$88k range acted as the buying zone during the dip. Buyers at those levels create a base; if those buyers step away, downside risk increases. Watch how fast sellers reappear on re-tests.

Resistance clusters and supply absorption

Supply clusters indicate where large holders or algorithmic sellers may execute. Clearing these clusters requires sustained demand. A series of closes above each cluster reduces the chance of a sharp reversal.

Volume, open interest, and sustainability signals

A healthy rally shows rising on-chain transfers, higher spot volume, and shrinking net short exposure. If volume is low, the rebound may be fragile and prone to reversal on negative headlines.

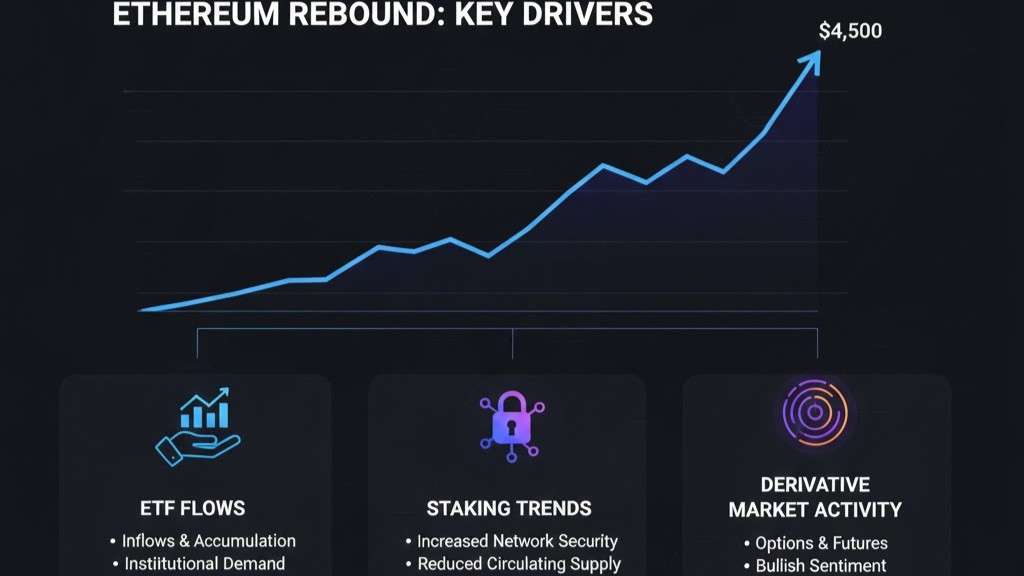

Ethereum’s recovery: ETFs, staking flows, and derivatives dynamics

Ethereum’s move back toward $3,000 reflects a mix of catalyst-driven flows. ETF-related instruments and institutional allocation signals have nudged investors to rebuild exposure; staking flows and network activity also influence demand. Derivatives markets show easing implied volatility, which points to reduced fear and a willingness to hold positions longer. For developers and DeFi users, a stable ETH price means cheaper gas dynamics for certain layer-2 interactions and clearer economics for yield strategies. Readers should pair price monitoring with protocol-level metrics — e.g., active addresses, staking inflows, and L2 volume — to understand whether ETH’s rebound is broad-based or concentrated in speculative derivatives demand.

ETF and institutional flow effects on ETH

Institutions allocating via ETFs or similar products can create sustained buy pressure. Even modest weekly inflows matter when liquidity is measured across spot and derivatives markets.

Staking, withdrawals, and on-chain supply dynamics

Staking locks reduce circulating ETH, which can support price. Conversely, large planned withdrawals or unlocks may increase sell pressure—tracking scheduled changes is crucial.

Derivatives cues: implied volatility and funding rates

Falling implied volatility and neutral funding rates often show the market is willing to hold positions longer and not hedge aggressively—this favors trend continuation if macro remains supportive.

Macro and policy backdrop: why rate-cut bets matter for crypto

The single largest macro driver this week has been the rising probability of a Federal Reserve rate cut in the near term. Markets price forward rate moves; higher chance of easing increases risk-appetite and supports assets priced for growth, including crypto. Lower policy rates reduce yields in traditional fixed-income instruments and can push allocators toward alternative assets. That said, the path and timing of policy shifts are uncertain; a premature pivot or mixed data could re-awaken volatility quickly. For your readers, the practical takeaway is that macro calendars matter: CPI, payrolls, and Fed commentary can cause rapid re-pricing in crypto. Grind News should continue linking price moves to real macro events to keep readers grounded.

How Fed expectations transmit to crypto markets

Expectations change derivatives positioning and margin requirements. When rate-cut odds rise, cash flows out of safe assets and some risk capital reallocates to higher-yield or higher-growth opportunities.

Monitoring economic releases and central bank guidance

Key data—employment, inflation, and manufacturing—can flip sentiment. Users should set alerts and avoid large, ill-timed trades around major releases.

Scenario planning for traders and investors

If rate cuts materialize, risk assets often rally; if data surprises to the upside, a rapid repricing could hit crypto. Readers should prepare stop-loss levels and sizing rules for both scenarios.

Market structure: ETFs, outflows, and how retail/institution flows interact

Even as price rebounds, ETF flows and institutional behavior create structural headwinds and tailwinds. Recent weeks have seen both withdrawals from some crypto ETFs and fresh inflows into other institutional products. Net flows determine how much capital underpins the rally. ETF outflows can cap upside by removing marginal liquidity, while spot accumulation by institutions can create durable price floors. For retail participants, knowing whether price action is driven by long-term accumulation or short-term rotations helps avoid getting trapped in fake breakouts. GrindToCash readers should watch weekly flow reports and exchange reserve changes for a clearer picture of supply-demand balance.

Exchange reserves and liquidity indicators

Falling exchange reserves often indicate supply being moved off-platform (potentially into cold storage), which can be bullish. Conversely, rising reserves suggest sellers ready to offload.

ETF inflows vs outflows: interpreting the net picture

Net flow matters more than headlines. Some funds may see outflows while others receive inflows; aggregation shows the real institutional appetite.

Retail behavior and short-term retail signals

Retail traders tend to buy into momentum and sell into fear. Social volume and derivatives retail metrics (e.g., perpetual funding spikes) can precede sharp moves; monitoring them helps time entries.

Short-term trading strategies and risk management for readers

With stabilization appearing, traders can adopt disciplined tactics: scale into positions with staggered buys, prefer smaller size near resistance, and use strict stop-losses tied to technical supports. Swing traders may watch consolidation above $90k for BTC and above $3,000 for ETH to confirm trend continuation. For position traders, building slowly and using dollar-cost averaging reduces timing risk. Risk management must emphasize capital allocation (never risk more than a small percent per trade) and liquidity planning (ensure exits exist during stress). GrindToCash’s guides on position sizing and stop placement are ideal internal links here for readers wanting step-by-step rules.

Entry tactics: scaling and confluence zones

Combine technical confluence (support + moving averages) with macro signals (rate outlook) to choose entries. Scaling reduces the impact of whipsaw volatility.

Stop placement and trade sizing rules

Place stops outside noise bands, not on arbitrary percentages. Keep trade size consistent with risk tolerance and portfolio exposure limits.

Hedging and contingency plans

Use options to hedge large positions or reduce downside. Keep a contingency plan: what you will do if markets gap against you overnight.

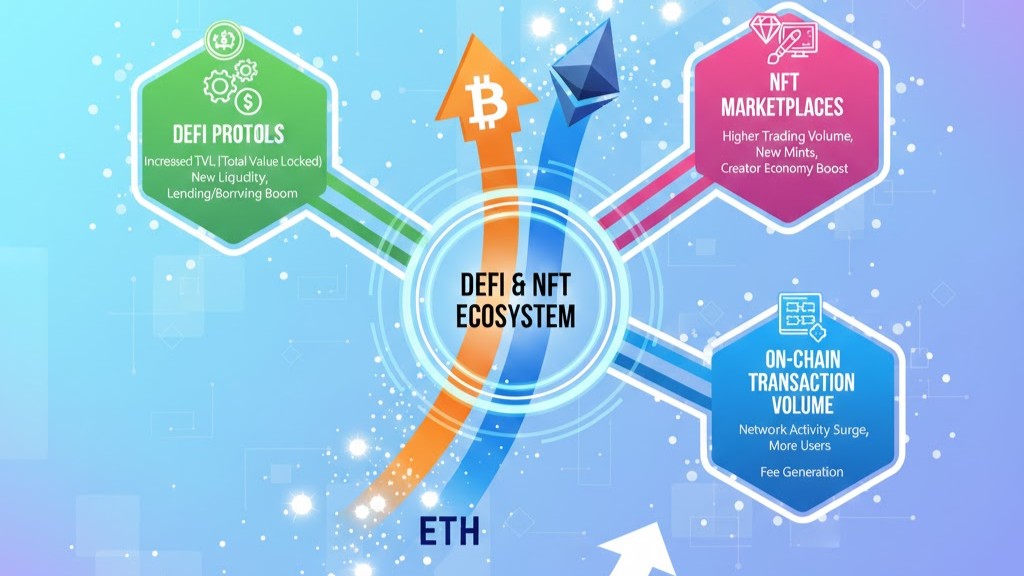

What this rebound means for DeFi, NFTs, and on-chain activity

When BTC and ETH stabilize, risk-on flows typically spill into DeFi and NFT activity. Rising ETH supports gas usage, which helps DeFi volume and NFT minting/sales. However, investors should look beyond price; true recovery shows in sustained on-chain metrics—active addresses, TVL in DeFi, and marketplace volumes. If those metrics rise alongside prices, the rebound is healthier and more likely to sustain. For GrindToCash readers interested in earning or participation strategies, this is the right time to research protocols, check audits, and evaluate tokenomics rather than chase headline pumps.

Monitoring on-chain health indicators

Track active addresses, transfer volumes, and new smart contract deployments. A durable rally corresponds with broad-based on-chain growth.

DeFi opportunities and cautionary checks

Rising yields may attract liquidity mining but beware unsustainable token emissions and unaudited pools. Always vet contracts first.

NFT market dynamics post-rebound

NFTs benefit from better sentiment, but creators and buyers should assess secondary market depth and long-term utility rather than short-term speculation.

Conclusion: staying informed and practical next steps for readers

The recent rebound in Bitcoin and Ethereum signals improving sentiment, but it is not a conclusive regime change. Traders and investors should combine technical levels, macro calendars, ETF/flow data, and on-chain health metrics to form a practical plan. For GrindToCash users, this means: update watchlists, run small test trades, follow protocol audits, and revisit position sizing rules. We will continue to monitor price action, flow reports, and central bank signals — and publish concise updates in Grind News as events unfold. Stay disciplined, use internal Grind Guides for risk rules, and always verify contract addresses before interacting on-chain.

Immediate watching list for readers

Watch BTC $93k–$96k supply cluster, ETH $3,000 level, Fed releases, ETF flow reports, and exchange reserve trends.

How GrindToCash will cover follow-ups

We’ll publish short updates for major macro events, plus deeper explainers on ETF dynamics and on-chain metrics for readers who want actionable insight.

Safety checklist before acting

Verify contracts, use small test transfers, prefer audited protocols, and do not overleverage—these simple steps protect capital during volatile re-pricing.