New Crypto Settlement Ledger Coming by Q1 2026

Global central banks prepare to launch a unified crypto settlement ledger by Q1 2026, aiming to revolutionize payments, tokenized assets, and global finance.

By Yaser | Published on October 31, 2025

What is the unified crypto settlement ledger

A unified crypto settlement ledger is a shared financial rail that lets approved institutions settle tokenized assets in near real time. It aims to connect central banks, commercial banks, and market infrastructures through a common, programmable layer. In practice, it could streamline cross-border payments, reduce counterparty risk, and lower operational costs. Moreover, it can standardize how regulated entities move Bitcoin, Ethereum based assets, stablecoins, and tokenized securities. Because settlement finality is vital, the design focuses on interoperability, auditability, and policy controls. As a result, investors see it as a potential bridge between traditional finance and the broader crypto economy.

The current pain points in cross-border settlement

Today, cross-border settlement involves multiple ledgers, time zones, and intermediaries. Each handoff adds costs, delays, and reconciliation work. Furthermore, messaging systems and asset systems are often separate, which creates room for breaks and errors. This setup slows innovation and makes liquidity management harder. Therefore, when volatility spikes, participants face higher margin needs and wider spreads. A shared rail could reduce these frictions. It could also improve transparency, because standardized records and timestamps help everyone verify status without lengthy email threads and manual checks.

The proposed solution and why it is different

The proposed ledger unifies messaging, asset transfer, and final settlement within a controlled environment. Instead of stitching systems together, participants coordinate on a common standard with clear rules. In addition, programmability allows conditional delivery versus payment and instant collateral release. This reduces trapped capital and shortens settlement cycles. Because compliance is embedded, supervisors can observe activity without revealing private trading strategies. In short, the model targets speed, certainty, and policy alignment at the same time, which is rare in current cross-border workflows.

Features investors care about most

Investors watch for three priorities. First, true atomic settlement that eliminates leg risk during volatile markets. Second, broad asset support, including major crypto assets, high quality stablecoins, and tokenized treasuries. Third, open yet permissioned access that invites competition among service providers. Additionally, clear uptime targets and transparent fee schedules matter. If those points hold, institutional demand can scale faster, because funds, brokers, and market makers can plan operations with fewer unknowns. Consequently, liquidity could deepen and trading costs could trend lower over time.

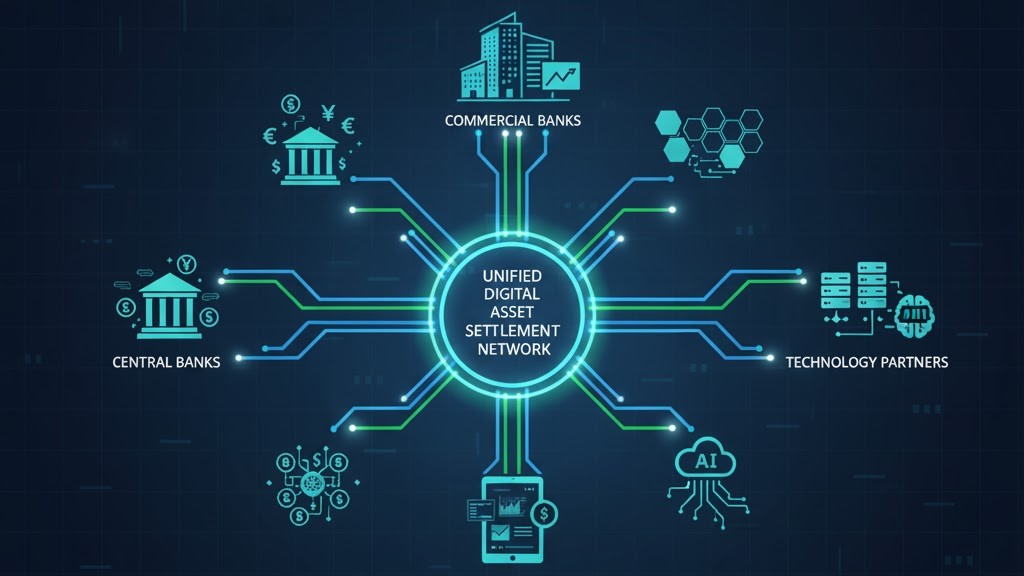

Who is likely to be involved and how roles may split

A project of this scope typically includes policy bodies, central banks, commercial banks, and market infrastructures. Each group brings different strengths. Policymakers define standards and safeguards. Central banks provide settlement finality and oversight. Commercial banks supply client access, distribution, and liquidity. Market infrastructures contribute connectivity and risk management. Technology partners support interoperability and security. Because interests differ, governance must balance innovation with prudence. Therefore, expect phased onboarding, strict testing, and clear operational manuals before broader access.

Central banks and policy coordination

Central banks can anchor the rulebook and ensure alignment with payment system objectives. They coordinate testing windows, resilience drills, and incident procedures. In addition, they set expectations for data handling and operational risk. This role does not mean they run every node or approve every transaction. Rather, they define the perimeter and the standards so others can build with confidence. Over time, coordinated oversight can reduce regulatory fragmentation and support cross-jurisdiction settlement without constant bilateral workarounds.

Commercial banks and market access

Commercial banks translate infrastructure into services. They handle client due diligence, onboarding, and account structures. Moreover, they provide credit lines, liquidity, and intraday funding that make settlement possible. Their desks can also create new products, such as tokenized repo or programmable cash management. Because client needs vary, banks will differentiate on analytics, risk tools, and service levels. If fees are transparent and integrations are clean, adoption can expand quickly and benefit both wholesale and large-cap crypto participants.

Technology partners and open standards

Technology partners help implement interoperability layers, custody hooks, and policy engines. Open standards reduce lock-in and enable independent audits. In addition, they allow future upgrades without breaking existing workflows. Security vendors contribute confidential computing, key management, and attestation, while network specialists optimize routing and monitoring. With shared reference implementations, smaller institutions can join without rebuilding everything from scratch. This broader participation can increase resilience and reduce concentration risk across the ecosystem.

Why the Q1 2026 window matters and what to expect

A Q1 2026 target concentrates minds. It sets a near-dated milestone for pilots to mature into production-grade services. Therefore, participants will spend late 2025 finalizing compliance, disaster recovery, and performance baselines. In parallel, they will publish service descriptions, fee ranges, and access criteria. For investors, this cadence provides visible checkpoints. If the schedule holds, price discovery around tokenized treasuries, blue-chip crypto, and stablecoin liquidity could improve. If slippage occurs, the delay itself will provide information about technical or policy bottlenecks.

Late 2025 preparation phase

During late 2025, expect broader end-to-end tests. Banks will run settlement rehearsals with synthetic positions and real operational teams. They will verify intraday funding, collateral substitution, and failover behavior. Moreover, they will test noisy market conditions to validate throughput and alerting. Documentation will harden. Playbooks for outages and reorg-like events will be rehearsed. In addition, connectivity with existing payment rails will be measured for latency and message completeness. This groundwork is critical for a clean early-2026 cutover.

Early 2026 launch window

In early 2026, the first production corridors could open with limited hours and capped volumes. This allows teams to observe live behavior without overwhelming capacity. As confidence grows, hours expand and caps rise. Meanwhile, onboarding widens from a handful of institutions to a broader group that met prior readiness checks. Because transparency builds trust, expect weekly status notes, incident summaries if any, and clear timelines for enabling new asset types or new currency pairs.

Post-launch stabilization and expansion

Following launch, attention shifts to stability, throughput, and client experience. Success metrics include average settlement time, message completion rates, and recovery times during drills. Feedback loops will inform parameter tuning, such as queue limits or collateral haircuts. In addition, service catalogs will broaden to include more tokenized instruments and additional stablecoin varieties. Over time, expanded hours and new regions will turn a corridor into a network, which increases utility for global portfolios.

How the network could work in practice

The network combines a permissioned settlement layer with interoperable asset ledgers. Institutions connect through gateways that enforce policy and identity. Settlement flows rely on atomic delivery versus payment so both legs complete together. Furthermore, programmable logic enables conditional release of funds and collateral. Because privacy matters, data is partitioned by role, and sensitive details are shared on a need-to-know basis. Standardized APIs let banks integrate core systems, custody, and risk engines without rebuilding their entire stack.

Asset tokenization and shorter cycles

Tokenization represents assets as digitally native units with clear ownership. With proper controls, coupon payments, corporate actions, and redemptions can be automated. This reduces errors and manual work. In addition, settlement cycles can shorten because finality does not depend on batched files and next-day reconciliations. For traders, faster cycles reduce margin drag and free capital sooner. For treasurers, predictable intraday windows help optimize liquidity buffers and reduce idle cash.

Interoperability and messaging standards

Interoperability requires a common language for messages and states. Gateways translate between internal systems and the settlement layer, while standards ensure that each message carries consistent fields. As a result, a payment confirmation in one corridor means the same in another. Moreover, cross-network bridges can connect regulated ledgers with public blockchains when policy allows. Clear interfaces reduce bespoke mappings and simplify audits. Consequently, integration timelines shrink and maintenance becomes more manageable.

Security, resilience, and confidentiality

Security relies on layered defenses. Keys are protected by hardware security modules and strict access policies. Nodes run on hardened infrastructure with continuous monitoring. Additionally, confidential computing and attestation can protect code and data in use, which is vital for competitive workflows. Resilience comes from geography-aware redundancy, regular disaster recovery drills, and clear failover procedures. Transparent incident reporting helps all participants refine controls and sustain trust over the long run.

What this could mean for investors and the crypto market

If the ledger goes live on time, investors could see tighter spreads, deeper order books, and more predictable funding conditions. Because settlement becomes faster, capital can rotate more efficiently across venues and strategies. Moreover, tokenized treasuries and high quality stablecoins may gain larger roles as collateral, which can support structured products and risk transfer. For the broader crypto market, improved rails can reduce fragmentation and make institutional participation less cumbersome, thereby encouraging longer-horizon capital.

Liquidity formation and price discovery

Better rails attract market makers who commit quotes when settlement risk is lower. As more firms compete, spreads compress and depth improves. This, in turn, sharpens price discovery during both calm and volatile periods. In addition, standardized settlement windows can align liquidity across time zones. Over time, a virtuous cycle can form: transparent costs invite more flow, and more flow supports healthier markets across flagship crypto assets and tokenized instruments.

Volatility, funding markets, and data quality

Volatility does not vanish, but funding shocks can ease when collateral moves faster and margin calls settle cleanly. Shorter settlement cycles also reduce daylight exposure, which supports tighter risk limits. Furthermore, standardized, high-quality data from settlement logs can improve analytics. Better data helps traders calibrate models and helps risk teams tune limits with confidence. This feedback loop can make markets more robust without muting the entrepreneurial energy that drives innovation.

Portfolio strategy and positioning

Investors may adjust portfolios to reflect lower friction. Strategies that were previously operationally heavy might become viable at scale. For example, cross-venue arbitrage, basis trades using tokenized treasuries, and structured carry strategies could see renewed interest. In parallel, long-only allocations can benefit from improved liquidity during entry and exit. As always, risk controls remain essential. Clear mandates, tested playbooks, and pre-agreed limits help teams capture new opportunities without overstretching.

Regulatory, legal, and operational considerations

No major market rail exists without a clear regulatory frame. Participation will require strict onboarding, KYC, AML, and ongoing monitoring. Legal agreements must define liability, data rights, and dispute processes. Operationally, firms need audited controls, change management, and resilient business continuity plans. Because jurisdictions differ, harmonization is hard work. Yet, with common standards and mutual recognition, corridors can open and grow. Therefore, institutions should prepare documentation early and run realistic tabletop exercises.

Compliance by design

Compliance works best when embedded, not bolted on. Gateways can enforce policy rules before messages hit the settlement layer. Role-based access keeps sensitive data limited to the right teams. Audit trails and immutable logs support regulators and internal auditors. In addition, clear retention policies and evidence packs speed up reviews. When compliance is part of the product, institutions move faster because checks are predictable and repeatable across geographies.

Jurisdictional alignment and supervisory cooperation

Cross-border activity depends on cooperation between supervisors. Memorandums of understanding can define data sharing, incident coordination, and testing protocols. Phased approvals allow progress without exposing the system to unbounded risk. Moreover, alignment on definitions, such as what constitutes finality, prevents misunderstandings. Over time, common templates reduce legal costs and make it easier for new participants to join corridors while respecting local rules.

Operational risk and contingency planning

Even with strong design, incidents will occur. Therefore, institutions need layered contingency plans. Secondary connectivity, warm standby nodes, and offline settlement playbooks reduce downtime. Clear communications help clients and partners understand status when issues arise. Post-incident reviews should produce concrete fixes, not just summaries. Regular drills keep teams sharp. With this discipline, the network can deliver high availability and quick recovery, which are essential for trust.

Implications for banks, fintechs, stablecoins, and CBDCs

For banks, the ledger can unlock new services and streamline existing ones. For fintechs, it offers cleaner integration points and faster settlement rails. For stablecoins, it provides a compliance friendly venue to demonstrate reliability at scale. For CBDCs, it offers a technical and policy blueprint for cross-border use. Because the model is modular, participants can plug in components over time. This incremental approach lowers switching costs and encourages experimentation within safe boundaries.

CBDCs and high quality stablecoins

CBDCs can serve as settlement cash within controlled corridors, while high quality stablecoins can complement coverage where CBDCs are not available. Both require strict issuance, reserves transparency, and redemption processes. If design choices align, institutions gain more options to move money with certainty. As adoption grows, spreads between instruments may narrow because risk is clearer. This clarity supports healthier competition and better outcomes for end users and treasurers.

FX, remittances, and corporate treasurers

FX desks and remittance providers can benefit from faster, cheaper cross-border settlement. Corporate treasurers may gain intraday visibility across currencies, which improves cash positioning and hedging. In addition, programmable flows can automate recurring payouts and reduce manual tasks. With better predictability, companies can hold leaner buffers and deploy capital where it matters. Ultimately, lower friction can help exporters, importers, and global service firms manage complexity with less overhead.

DeFi bridges and institutional gateways

Regulated gateways can connect the ledger to approved DeFi venues when policies allow. This could enable secure liquidity sharing and risk transfer without exposing institutions to unmanaged counterparty risk. Clear standards for wrapping assets, proving reserves, and enforcing limits are essential. If these controls work, institutions may tap on-chain liquidity during stress, and retail-institutional separation can remain intact. Over time, careful bridges can turn fragmentation into a source of optionality.

What to watch next and how to prepare

Investors should track concrete, near-term signals. Look for official testing calendars, public readiness checklists, and announcements of production corridors. Monitor which assets are first, what hours are supported, and how fees are structured. In addition, watch onboarding pipelines and service catalogs from major banks. Prepare by mapping internal processes, upgrading data pipelines, and drafting execution playbooks. With a plan in place, you can act when windows open rather than react after opportunities pass.

Confirmation signals before go-live

Useful signals include published service level targets, signed participation agreements, and successful end-to-end pilots with measurable throughput. Another signal is the release of standardized message schemas and audit procedures. Finally, third-party attestations of security controls and disaster recovery readiness indicate a mature launch posture. When these pieces appear in public, confidence rises that early 2026 is achievable and that the first corridors will operate within robust guardrails.

Key metrics to track after launch

After launch, track average settlement time, failure rates, and recovery times. Observe fee stability and corridor uptime. Watch depth and spreads around settlement windows to see if liquidity concentrates. Review onboarding velocity as a proxy for commercial traction. Over time, compare performance across corridors and assets. These metrics tell you whether the network is gaining real utility or simply running pilots with different branding.

Scenarios for 2026 and how they affect strategy

In a bull scenario, corridors scale quickly, fees fall, and asset coverage expands. Investors can position for deeper liquidity and more efficient funding. In a base scenario, adoption grows steadily, with measured risk taking and gradual fee compression. In a bear scenario, delays occur due to policy or technical hurdles, and scope narrows. Even then, preparation is valuable because documentation, controls, and playbooks improve execution quality across any market condition.