Your ULTIMATE Edge: Crypto Prices by Supply & Demand

Unlock your ultimate edge in crypto! Master how supply & demand drive digital asset prices. Get critical insights to predict market moves & boost your portfolio on GrindToCash.

By Yaser | Published on October 14, 2025

The Fundamental Forces: Supply & Demand in Crypto

At the very core of every financial market, including the highly volatile realm of cryptocurrency, lie the immutable forces of supply and demand. These two fundamental economic principles dictate price movements, determining whether an asset’s value will soar, plummet, or remain stable. For any individual seeking to truly understand and, moreover, gain an ultimate edge in crypto investing, grasping these dynamics is absolutely indispensable. Our GrindToCash platform is committed to demystifying these concepts, providing a robust foundation for making informed decisions, because predicting price action isn’t about guesswork; rather, it’s about understanding these underlying economic currents.

Defining Supply in the Crypto Context

Indeed, understanding “supply” in the cryptocurrency context involves more than just the total number of coins ever minted. It encompasses the circulating supply—the tokens currently available for public trading—as well as the emission schedule, which dictates how new tokens are introduced into the market over time. Factors such as token burns, locked stakes, and vesting periods significantly influence this supply side. Consequently, a limited or decreasing supply, especially when demand is high, often acts as a powerful catalyst for price appreciation, a crucial insight for GrindToCash members analyzing tokenomics.

Defining Demand in the Crypto Context

Conversely, “demand” for a cryptocurrency is a multifaceted concept driven by various factors. It includes genuine utility within a blockchain’s ecosystem, speculative interest from investors, institutional adoption, and even market sentiment fueled by news and social media. The more a token is used for transactions, staking, or accessing decentralized applications, the higher its organic demand. Therefore, a surge in demand, particularly when supply is constrained, inevitably pushes prices upwards, making this a critical metric for GrindToCash users evaluating a project’s real-world adoption and potential.

The Equilibrium: Where Supply Meets Demand

Ultimately, the interplay between supply and demand constantly seeks an equilibrium point—a price at which the quantity of tokens buyers are willing to purchase precisely matches the quantity sellers are willing to offer. When demand outstrips supply, prices rise; conversely, when supply exceeds demand, prices fall. This dynamic relationship is perpetually in flux, influenced by a myriad of internal and external factors. Hence, recognizing this constant push and pull is foundational for understanding market movements, providing GrindToCash readers with the core principles of crypto valuation.

Factors Influencing Crypto Supply Dynamics

Delving deeper into the supply side, it becomes evident that the total number of cryptocurrencies in existence, or those available for trading, isn’t a static figure. Rather, it is a dynamic quantity influenced by a series of deliberate design choices made by project developers, alongside ongoing network activities. For investors aiming to gain an ultimate edge on GrindToCash, comprehending these factors is paramount. This insight enables a more nuanced understanding of a token’s potential scarcity, which, in turn, can significantly impact its long-term value proposition, moving beyond simple total supply figures to a more sophisticated analysis.

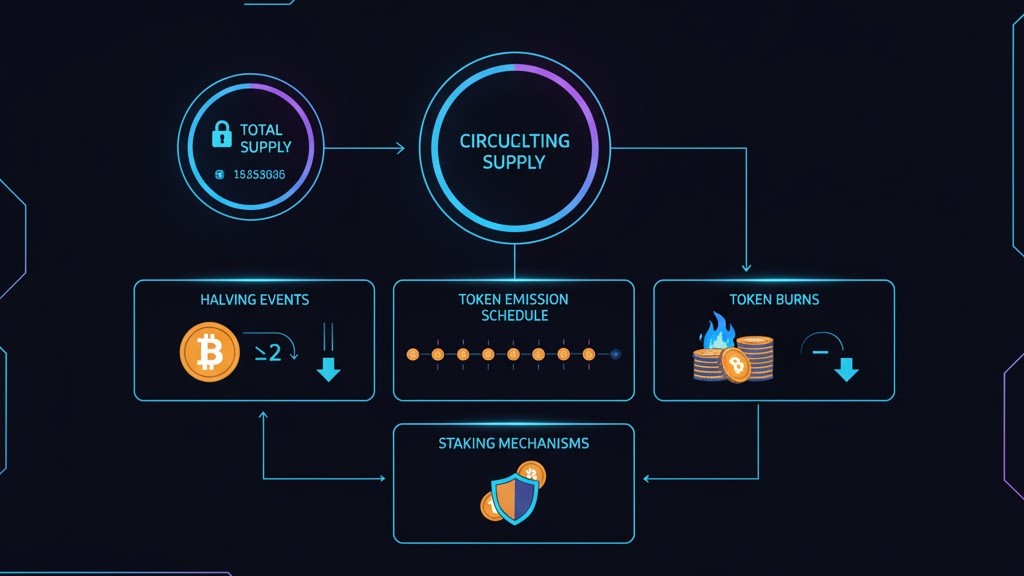

Total Supply vs. Circulating Supply

Indeed, a common point of confusion for new investors is differentiating between “total supply” and “circulating supply.” Total supply refers to the maximum number of tokens that will ever exist, often capped by the protocol’s design. Circulating supply, however, refers to the tokens currently available and actively traded in the market. Consequently, a large difference between these two figures, especially if a significant portion of the total supply is locked or unreleased, can impact immediate price action. GrindToCash emphasizes analyzing both metrics for a complete market picture.

Token Emission Schedules and Halving Events

Furthermore, the rate at which new tokens are introduced into the circulating supply is governed by the project’s “emission schedule.” For many cryptocurrencies like Bitcoin, this involves pre-defined events such as “halving,” which periodically cut the rate of new token creation in half. These scheduled reductions in supply often create significant upward price pressure. Hence, understanding these emission schedules and anticipating major supply shocks is crucial for predicting long-term price trends and is a key analytical tool for GrindToCash users.

Token Burns and Staking Mechanisms

Conversely, certain mechanisms can actively reduce the circulating supply, thereby creating deflationary pressure. “Token burns” involve permanently removing tokens from circulation, often through protocol upgrades or as part of fee structures. Similarly, “staking mechanisms” lock up significant portions of a token’s supply, as holders commit their assets to secure the network or participate in governance. As a result, both token burns and staking effectively reduce the available supply, potentially leading to price appreciation if demand remains constant or increases, a dynamic closely watched by GrindToCash.

Decoding Crypto Demand Drivers

While supply dynamics lay the groundwork, it is the intricate and often rapidly shifting forces of demand that truly ignite significant price movements in the cryptocurrency market. Demand is far more complex than a simple preference for an asset; rather, it is a confluence of real-world utility, speculative interest, and ever-evolving market sentiment. For those seeking an ultimate edge, GrindToCash provides the framework to decode these drivers, offering crucial insights into why certain cryptocurrencies suddenly gain traction or experience sustained growth, allowing for more strategic investment decisions.

Utility and Adoption: Real-World Use Cases

Indeed, the most sustainable form of demand for any cryptocurrency stems from its real-world utility and adoption within its native ecosystem. Tokens that serve a genuine purpose—such as paying for network fees, facilitating decentralized applications (dApps), or acting as governance tokens—generate organic demand as users engage with the blockchain. Consequently, projects solving tangible problems or providing essential services tend to attract consistent usage. This foundational utility is a powerful long-term demand driver, a factor GrindToCash meticulously analyzes when evaluating project viability.

Speculation and Investor Sentiment

Furthermore, a significant portion of crypto demand, particularly in shorter timeframes, is driven by speculation and investor sentiment. News events, social media trends, influencer endorsements, and macro-economic factors can all rapidly shift how investors perceive an asset’s future value. Positive sentiment can trigger a buying frenzy, while negative news can lead to rapid sell-offs. As a result, understanding market psychology and how it can inflate or deflate demand is crucial for GrindToCash users navigating volatile crypto markets.

Institutional Interest and Market Liquidity

Crucially, the increasing interest from institutional investors—including hedge funds, asset managers, and corporations—is becoming a powerful demand driver. Large capital injections from these entities can significantly boost a token’s price and liquidity. Their entry often brings greater legitimacy and stability to the market, attracting even more retail investors. Therefore, tracking institutional adoption and major investment announcements is a key indicator of growing demand, providing valuable insights for the GrindToCash community.

The Price Mechanism: Where Forces Collide

Ultimately, the captivating dance between supply and demand culminates in the cryptocurrency’s price mechanism—the point where these two powerful forces collide and constantly adjust. This ongoing interaction isn’t a static event; rather, it’s a dynamic, moment-to-moment recalibration that dictates the current market value of any digital asset. For GrindToCash readers, comprehending this intricate ballet is fundamental to predicting market movements with greater accuracy. This involves understanding how even minor shifts in either supply or demand can trigger ripple effects, leading to significant price changes.

Price Discovery: Buyers and Sellers Converge

Indeed, “price discovery” is the continuous process by which buyers and sellers interact in the open market to determine the current market price of a cryptocurrency. Through bids (buy orders) and asks (sell orders) on exchanges, the market finds a price at which a transaction can occur. If there are more buyers than sellers at a given price, the price will tend to rise until enough sellers appear. Conversely, an abundance of sellers will push the price down. This constant negotiation is the essence of market dynamics, which GrindToCash aims to help you master.

Market Cap, Volume, and Liquidity

Furthermore, price dynamics are heavily influenced by market capitalization, trading volume, and liquidity. Market cap (price multiplied by circulating supply) indicates a project’s overall size. High trading volume suggests strong interest and activity, while high liquidity ensures that large orders can be executed without drastically moving the price. Projects with low liquidity can experience extreme volatility from relatively small buy or sell orders. Consequently, GrindToCash always advises examining these metrics to assess a token’s market health and stability.

Order Books and Market Depth

Crucially, “order books” on cryptocurrency exchanges provide a real-time snapshot of the current supply and demand at various price levels. They show pending buy orders (bids) and sell orders (asks) for a specific asset. Analyzing the depth of these order books—how many orders are stacked at different prices—can give insights into potential support and resistance levels. A thick order book suggests strong interest at certain price points, offering valuable predictive power for GrindToCash users looking to anticipate short-term price movements.

Macroeconomic Influences on Supply & Demand

Beyond the intrinsic tokenomics and project-specific developments, the broader macroeconomic landscape exerts a profound influence on both the supply and demand dynamics of the entire cryptocurrency market. For investors on GrindToCash seeking an ultimate edge, neglecting these larger economic forces would be a critical oversight. Global economic trends, central bank policies, and geopolitical events can fundamentally alter investor sentiment and capital flows, impacting everything from Bitcoin’s price to the valuations of smaller altcoins, creating powerful headwinds or tailwinds that require astute observation.

Interest Rates and Global Liquidity

Indeed, central bank interest rates are a potent macroeconomic driver. When interest rates rise, the cost of borrowing increases, and traditional, less risky investments (like bonds) become more attractive. This can divert capital away from riskier assets like cryptocurrencies, reducing overall demand. Conversely, lower interest rates or quantitative easing injects more liquidity into the system, often flowing into speculative assets. Consequently, monitoring central bank policy is paramount for GrindToCash readers tracking crypto’s responsiveness to global capital flows.

Inflation and Fiat Currency Devaluation

Furthermore, inflation and the potential devaluation of fiat currencies can significantly impact the demand for certain cryptocurrencies. Bitcoin, in particular, is often seen as a hedge against inflation due to its fixed supply and decentralized nature. When confidence in traditional currencies erodes, demand for Bitcoin as a store of value can surge. Therefore, understanding inflationary pressures and currency strength is crucial for predicting shifts in crypto demand, a key analytical area for GrindToCash, especially for those seeking to protect purchasing power.

Geopolitical Events and Economic Stability

Crucially, major geopolitical events—such as conflicts, trade wars, or political instability—can also trigger significant shifts in crypto supply and demand. During times of heightened uncertainty, some investors may flock to cryptocurrencies as a perceived safe haven, independent of traditional financial systems. Others may de-risk entirely, pulling capital from all volatile assets. Consequently, these events can create rapid, unpredictable price movements, emphasizing the need for GrindToCash users to stay informed about global affairs and their potential market repercussions.

Understanding Market Cycles and Sentiment

The cryptocurrency market is renowned for its pronounced cycles, often characterized by periods of euphoric growth followed by sharp corrections. These cycles are not random; rather, they are deeply intertwined with the interplay of supply, demand, and, critically, market sentiment. For those on GrindToCash aiming to gain an ultimate edge, deciphering these cycles and the underlying psychological shifts is as important as understanding technical analysis. This holistic approach helps in anticipating major turning points, enabling more strategic entry and exit points in a notoriously emotional market.

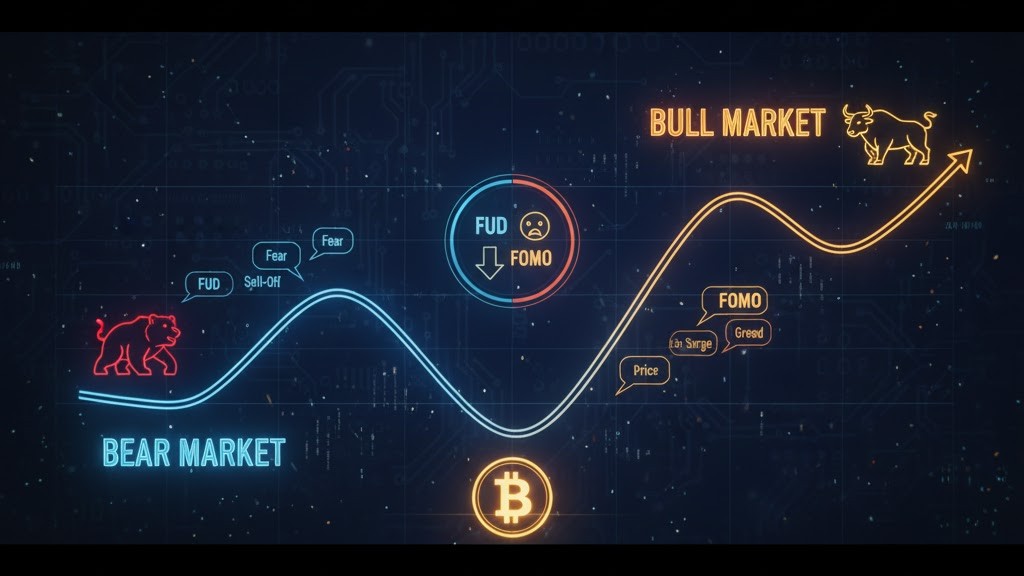

Bull Markets: Demand Overwhelms Supply

Indeed, a “bull market” is characterized by sustained price appreciation, where demand consistently outstrips available supply. During these periods, positive news, increasing adoption, and general optimism fuel a buying frenzy. Fear of Missing Out (FOMO) often drives new capital into the market, further inflating demand. As a result, prices climb rapidly, and even less fundamentally strong projects can experience significant gains. GrindToCash advises caution during peak euphoria, as such periods often precede inevitable corrections.

Bear Markets: Supply Exceeds Demand

Conversely, a “bear market” is defined by prolonged price declines, where selling pressure (supply) overwhelms buying interest (demand). Negative news, regulatory crackdowns, or broader economic downturns can trigger widespread pessimism and a flight to safety. As investors liquidate holdings, prices fall, and liquidations can cascade, creating downward spirals. This environment often tests the conviction of even seasoned investors. However, GrindToCash views bear markets as critical opportunities for long-term accumulation, for those with a strong understanding of fundamental value.

The Role of FUD and FOMO

Furthermore, market sentiment is heavily influenced by “FUD” (Fear, Uncertainty, and Doubt) and “FOMO” (Fear Of Missing Out). FUD can lead to irrational selling, as negative rumors or news spread rapidly, causing investors to panic and offload assets. Conversely, FOMO can drive irrational buying, as investors rush into a rising market, fearing they will miss out on potential gains. Both FUD and FOMO represent powerful psychological forces that can temporarily distort traditional supply and demand dynamics, making emotional intelligence a key tool for GrindToCash users.

Actionable Strategies for GrindToCash Readers

Armed with a comprehensive understanding of how supply and demand shape crypto prices, GrindToCash readers are now better positioned to develop actionable strategies for navigating this dynamic market. This knowledge transcends mere theoretical understanding; rather, it empowers you to make informed, data-driven decisions that can significantly enhance your portfolio’s performance. By applying these principles, you can move beyond speculative guesswork and adopt a more strategic approach to crypto investing, truly gaining that ultimate edge promised by GrindToCash.

Analyzing Tokenomics for Supply Insights

Indeed, a crucial first step involves meticulously analyzing a project’s tokenomics to gain deep insights into its supply-side dynamics. This means scrutinizing its total supply, circulating supply, emission schedule, and any burning or staking mechanisms. Understanding when new tokens will enter the market or when significant portions will be locked up can provide valuable foresight into potential supply shocks. Consequently, this detailed tokenomic analysis is a cornerstone of smart investing, a skill GrindToCash consistently develops within its community.

Tracking On-Chain Metrics for Demand Signals

Furthermore, for decoding demand signals, tracking on-chain metrics offers invaluable insights that go beyond mere price charts. This includes monitoring active wallet addresses, transaction volumes, network usage (e.g., dApp interactions), and developer activity. A consistent increase in these metrics often signals growing organic demand and real-world adoption, indicating underlying strength. Therefore, integrating on-chain analysis into your research provides a more holistic view of a project’s true demand, a sophisticated approach advocated by GrindToCash.

Utilizing Technical and Fundamental Analysis

Ultimately, combining a deep understanding of supply and demand with both technical and fundamental analysis provides the most robust framework for investment decisions. Fundamental analysis assesses a project’s long-term value based on its technology, team, use case, and tokenomics. Technical analysis, conversely, studies price charts and trading volumes to identify patterns and predict future price movements. Integrating these approaches allows GrindToCash users to make well-rounded, informed decisions, capitalizing on both long-term potential and short-term trends.

Conclusion: Your Ultimate Edge in the Crypto Market

In conclusion, the intricate dance between supply and demand stands as the singular most powerful force dictating cryptocurrency prices. Our comprehensive guide on GrindToCash has meticulously broken down these fundamental economic principles, revealing how tokenomics, macroeconomic factors, market sentiment, and real-world utility collectively influence the valuation of digital assets. From understanding the nuanced differences between total and circulating supply to decoding the diverse drivers of demand, you are now equipped with knowledge that transcends superficial market observations.

For every dedicated member of the GrindToCash community, this in-depth understanding is not merely academic; rather, it is your ultimate edge. It empowers you to move beyond the noise and FUD, enabling you to make more informed, strategic, and ultimately, more profitable investment decisions. By continuously analyzing supply dynamics, tracking demand signals, and integrating this knowledge with sound technical and fundamental analysis, you position yourself to anticipate market shifts rather than merely react to them.

As the crypto market continues its rapid evolution, driven by both innovation and inherent volatility, the principles of supply and demand will remain constant. GrindToCash is committed to being your trusted partner, providing the cutting-edge insights and educational resources necessary to master these forces. Embrace this knowledge, apply these strategies, and confidently navigate the thrilling world of cryptocurrency, securing your ultimate edge in the digital financial frontier.