What Is Worldcoin and How Does It Really Work?

Discover what Worldcoin (WLD) is and how it really works. Learn how this bold project merges biometrics, blockchain, and identity to shape the future of crypto.

By Yaser | Published on October 26, 2025

What Is Worldcoin—and Why People Care in 2025

Worldcoin is a project launched in 2023 that aims to give every person a privacy-preserving, portable “proof of personhood” called World ID. Verification happens at a polished metal device—the Orb—which scans your irises to confirm you’re a unique human (not a bot). After verification, the claim is that biometric images are processed to create an iris code, then the images are deleted; your World ID lives in World App on your phone. Alongside the ID system, a token called WLD exists for governance, incentives, and network usage in the broader World ecosystem.

The Vision—Proof of Human at Internet Scale

The big idea is simple: make it easy for apps to tell they’re interacting with a real, unique person—without learning who you are. If this works, things like airdrops, voting, ticket sales, and spam controls become harder to game because one person cannot pretend to be many. Worldcoin frames this as “digital proof of human” that you can take to different services, including Mini-Apps inside World App and, over time, third-party platforms that integrate the protocol.

The Hardware and the Flow in Plain English

Practically, you book a session, show up to an Orb, and look at the lens. The device captures iris images, derives a unique iris code, and checks that your code doesn’t already exist in the network. The company states the images are then deleted; what remains is a cryptographic proof linked to your World App, not your real-world identity. From there, you can sign in to apps with World ID to prove “I’m a unique person” without giving a name, email, or phone—at least in theory, depending on each app’s policy.

The App Layer—World App and Daily Use

World App (built by Tools for Humanity) is a simple wallet that stores your World ID, lets you explore tokens, and—in eligible regions—claim WLD. It also exposes “Mini Apps” for common actions. The design goal is inclusion: a straightforward, mobile-first way to interact with the World Network and Ethereum rails. Importantly, what you can do varies by country due to local rules, so availability notices inside the app matter.

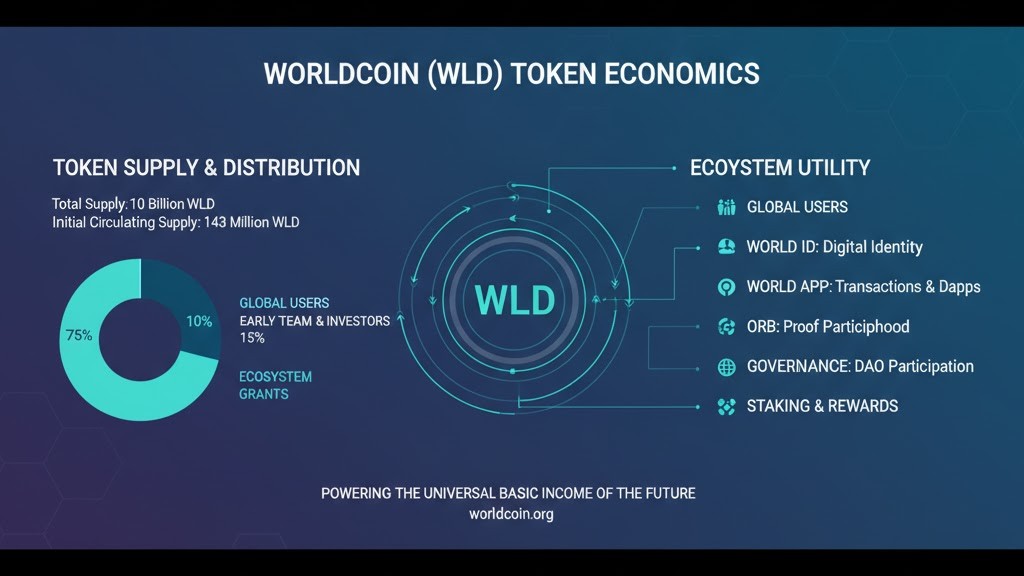

Token Basics—Supply, Utility, and Distribution

WLD’s fixed supply is 10 billion for the first 15 years. Governance may later approve up to 1.5% annual inflation. Distribution heavily favors users and the ecosystem over time, with a large share earmarked for people who verify their World ID (subject to local eligibility). Utility today centers on governance, network incentives, and usage fees inside the World stack (including its L2 plans), with details evolving as integrations expand. For any action, always confirm the official contract, distribution notes, and regional eligibility before assuming availability.

How Users Receive WLD

In some jurisdictions, verified users have been able to claim WLD in-app as part of community incentives. The critical detail: this is not universal; local laws determine whether the claim is active. The project keeps messaging that user allocations are a key part of long-term tokenomics, but rollouts differ by region and may change. Therefore, treat all distributions as location-dependent and always read in-app notices before planning around them.

Governance and Future Levers

WLD holders can vote on parameters such as emissions after year 15, funding of ecosystem initiatives, and potentially protocol features as governance deepens. This means tokenholders share responsibility for balancing incentives, privacy safeguards, and growth. For readers of GrindToCash, it’s wise to separate ideology from mechanics: follow the official posts and change logs rather than social media summaries when evaluating governance proposals.

Data Hygiene—Never Rely on One Aggregator

Market trackers are helpful but can lag on smaller or fast-changing tokens. If volume, circulating supply, or contract details look odd, cross-check with the official site and the latest tokenomics explainer. A minute of verification protects you from stale snapshots, fake tickers, or copycat contracts you didn’t intend to touch. This habit is basic but powerful for any niche asset.

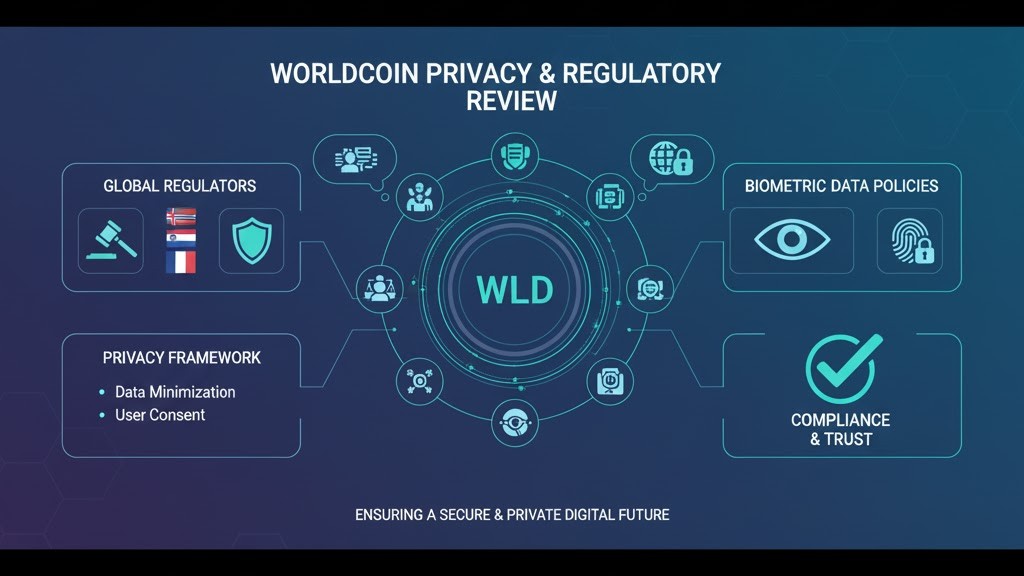

Privacy and Compliance—What the Project Says vs. What Regulators Say

Worldcoin emphasizes privacy by design: the Orb checks uniqueness, generates an iris code, and deletes images; your World ID stays on your phone, and you control what you share. At the same time, multiple regulators have intervened. Spain’s data authority temporarily banned Orb operations in 2024; later, a Bavarian ruling required deletion of stored iris data and stricter consent conditions. In Kenya, the High Court in May 2025 found the biometric collection unlawful under its privacy laws. Recently, Thai authorities raided a Bangkok “iris hub” over alleged unlicensed token distribution. These actions show a live regulatory debate.

Reading the Project’s Privacy Claims Carefully

On official pages, the team explains that no personal identity is required and that the Orb does not keep images; it processes them to create an iris code, then deletes them. Users retain control via World App. This design aims to minimize data collection while still delivering a useful “proof of personhood.” Nevertheless, local law can demand extra controls, audits, or pauses. Always weigh claims alongside country-specific rulings if you care about compliance and data rights.

What Regulators Have Actually Done

Spain’s AEPD used emergency powers to halt scanning, citing privacy risks and consent/under-18 concerns; a later decision associated with Bavarian oversight ordered deletion of iris records and explicit consent guarantees. Kenya’s High Court decision in 2025 declared the prior collection unlawful under Kenyan law. In October 2025, Thailand’s SEC and cyber unit reportedly raided an Orb site over licensing issues. These actions vary in scope but share a theme: biometric data demands high safeguards.

The Investor Takeaway—Policy Risk Is Not Theoretical

For readers, the lesson is straightforward: understand that legal status depends on where you are. A feature available in one country can be paused in another. If you cover Worldcoin in content or build on top of it, track official notices and regulator updates in your region. Policy risk can change user growth, token flows, and integration timelines—even when the tech itself doesn’t change.

Adoption Signals—Users, App Activity, and Treasuries

Adoption comes in different forms: verified World IDs, World App usage, developer integrations, and even corporate treasuries experimenting with WLD. In 2025, headlines included a U.S.-listed company (Classover) adding WLD to its treasury; other treasury-related mentions have appeared in the news cycle as firms test narratives around digital identity and access. While a few stories don’t define mass adoption, they show curiosity beyond crypto-native circles and provide case studies for how tokens might appear on balance sheets. Track these signals to see whether interest is broadening.

World App as the Practical On-Ramp

The app is where the idea becomes concrete for users: hold your World ID, explore Mini Apps, and (where eligible) claim WLD. Because the interface is mobile-first and simplified, it reduces friction for non-technical users. Feature availability changes by country; in-app messages reflect this. For on-the-ground reality, World App metrics and product notes often tell you more than high-level narratives do.

Developers and Mini-Apps

For builders, value shows up when identity-gated experiences are easier to deploy: one-person-one-account limits, bot-resistant signups, fair airdrops, and voting. Mini-Apps offer early distribution inside World App, but the larger opportunity is external websites that integrate World ID without forcing users to reveal personal data. Watch for credible third-party case studies; they are the best evidence of product-market fit.

Treasuries—Small but Symbolic

When a listed company publicly adds WLD to reserves, it signals narrative value—identity plus access—as much as pure price speculation. This doesn’t guarantee liquidity depth or risk neutrality, but it showcases institutional experiments. For readers, treasury news is a sentiment indicator: if it grows, so might comfort with the asset class; if it fades, the opposite. Always read the filings and announcements, not just tweets.

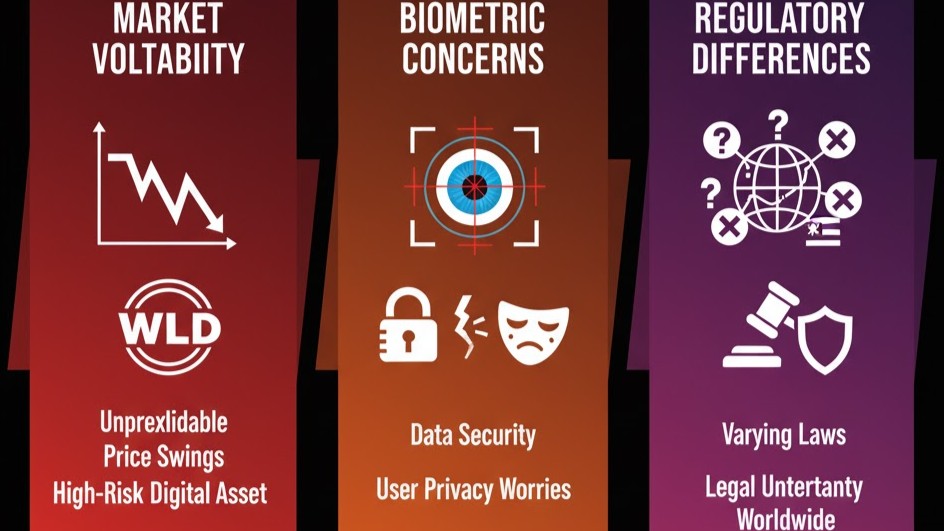

Risks and Trade-Offs—Volatility, Biometrics, and Jurisdiction Gaps

Three risk buckets stand out. First, volatility: WLD trades in crypto markets and can swing on headlines. Second, biometrics: even with privacy engineering, some people and some regulators view iris scanning as inherently sensitive. Third, jurisdiction gaps: the same product can be green-lit, paused, or fined depending on where it’s offered. None of this makes the project “bad”; it just defines the terrain. If you’re following Worldcoin as technology or a case study, track risks with the same discipline you use for tokenomics.

Volatility and Headlines

Price predictions exist across media, but they’re speculative by nature. What does matter is how quickly sentiment shifts when policy or operational news lands. Small caps move faster; liquidity pockets matter; and global hours mean headlines can hit anytime. If you’re simply learning, focus on verified facts and official pages—then decide whether market exposure even makes sense for your goals.

Biometrics and Consent

Even if images are deleted and only an iris code remains, some jurisdictions want additional controls, audits, or opt-outs—especially for minors. From a user-rights perspective, clarity about consent, storage, and deletion is non-negotiable. From an ecosystem perspective, the higher the bar, the more durable the product becomes if it meets that bar. Expect the bar to rise, not fall.

Regional Fragmentation

Kenya’s High Court ruling, Spain’s temporary bans and later data-deletion order, and the Thai raid show how outcomes diverge. Fragmentation slows unified growth but can also guide improvements: products that adapt to stricter requirements often come out stronger. If you build with or write about Worldcoin, always attach country context to any claim about availability or compliance.

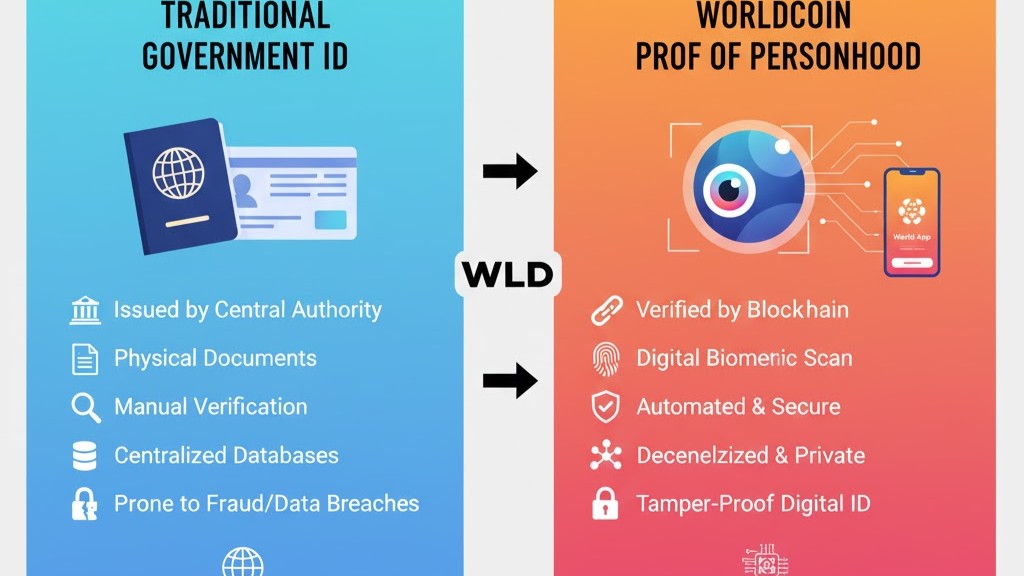

Comparisons—What Makes Worldcoin Different from “Regular” IDs

Traditional digital IDs usually attach to a government or corporate database. Worldcoin tries to flip the model by proving uniqueness without revealing identity, using a privacy-preserving proof. This is more like a reusable anonymous ticket than a name tag. If it works at scale, bots, multi-account abuse, and sybil attacks become harder. If adoption stalls or privacy doubts persist, it remains a niche tool. Either way, the experiment advances the conversation about what “identity” should mean online.

Use Cases Beyond Crypto

Identity-gated ticket sales, fair voting in online communities, spam-limited social platforms, or “one-per-person” discounts are all use cases that don’t require your name—only uniqueness. The benefit is reducing abuse without building giant personal databases. The trade-off is accepting a biometric step at enrollment, which some users will decline on principle. That social trade-off will shape adoption more than any single price chart.

Where Government IDs Still Win

Government IDs anchor legal identity, property rights, and services. They’re not going away. Instead, a privacy-preserving proof of personhood could sit alongside them for low-stakes, high-volume internet tasks. The combo could mean fewer bots and less spam while keeping your legal identity out of everyday sign-ins—if, and only if, privacy claims hold up under audits and law.

Developer Reality—APIs and Trust Layers

For developers, integration choices depend on cost, ease, user experience, and—most importantly—trust. If World ID reduces bot traffic or fraud without scaring users, developers will test it. If onboarding or regulation gets in the way, they’ll pause. Watch for credible reference apps and transparent metrics; they’re the adoption story in one line.

Recent Headlines You Should Know

To keep this guide practical, here are notable 2024–2025 events: Spain’s privacy regulator temporarily banned Orb scans; a Bavarian decision later required deletion of iris records and stricter consent. Kenya’s High Court in May 2025 ruled the earlier biometric collection unlawful under local law. In October 2025, Thailand’s SEC and cyber unit raided a Bangkok site over licensing concerns. Meanwhile, Classover (NASDAQ: KIDZ) publicly added WLD to its treasury in October 2025, showing corporate experimentation alongside regulatory friction.

Why These Headlines Matter for Readers

For learners and builders, these events show the difference between a product vision and real-world rollout. They also underline how identity tech touches privacy law, which moves slower than software. If you write, build, or plan around Worldcoin, attach dates and jurisdictions to every claim so readers know what changed and where.

Signals vs. Noise

Treasury adds, country pauses, and new pilots will continue to rotate through the news cycle. The signal is direction: do integrations and compliant use cases keep growing across credible partners? The noise is week-to-week price chatter that doesn’t change adoption fundamentals. Keep a small watchlist of official posts and third-party rulings to filter both.

How to Track Without Spending All Day

Bookmark world.org product pages for technical updates, and save regulator press rooms for your region. A 5-minute weekly check is enough to stay current on availability and policy. You’ll learn faster and avoid outdated assumptions that spread on social media.

Bottom Line for GrindToCash Readers

Worldcoin sits at the intersection of biometrics, privacy, and crypto utility. It offers a bold solution—proof of human without identity—while inviting real scrutiny from courts and regulators worldwide. If you’re here for knowledge, treat it as a case study in how Web3 collides with law. If you’re here for products, remember that features, claims, and token access change by country. For our readers, the winning approach is simple: learn the architecture, follow official updates, and map every headline to time and place before you act. (Educational content; not financial advice.)

What to Watch Next

Three things: (1) privacy audits or third-party reviews that confirm deletion/consent practices, (2) regulator decisions that allow or limit Orbs in major markets, and (3) real apps using World ID to reduce spam or fraud. These together will tell you if the idea scales or stalls.

How to Read Any New Announcement

Ask: what changed technically, what changed legally, and for whom (which country)? If an announcement doesn’t answer those, wait for details. Clear facts beat fast takes—especially in identity and compliance.

Where This Fits in Grind Basics

This piece belongs in Grind Basics because it explains the how and why of a major Web3 experiment without asking readers to trade. It builds foundation knowledge so that future guides—whether about privacy-preserving identity or non-trading opportunities—make more sense and deliver real value.