Taiko (TAIKO): Essential Guide to the ZK Ethereum L2

Learn Taiko (TAIKO), an EVM-equivalent ZK Ethereum L2: how it works, fees, wallets, bridges, security, and dApp growth—steps to start faster on-chain.

By Yaser | Published on November 19, 2025

What Taiko Is—and Why It Matters to Everyday Users

Taiko is a zero-knowledge (ZK) Layer-2 network that settles on Ethereum while keeping full EVM equivalence. In simple terms, it aims to run your favorite Ethereum apps faster and cheaper, without forcing developers to rewrite smart contracts or learn exotic tooling. Because Taiko posts data to Ethereum and proves state transitions with succinct ZK proofs, users get strong security guarantees inherited from Layer-1. And since fees tend to be lower than mainnet—especially during congestion—consumer experiences such as swaps, mints, and micro-payments feel more practical. For readers of GrindToCash, this means a realistic way to use on-chain finance with fewer delays, clearer costs, and a path that respects safety.

EVM Equivalence Explained in Plain English

EVM equivalence means the chain behaves like Ethereum’s virtual machine at a bytecode level. Practically, this lets teams deploy the same contracts, use the same libraries, and keep the same audits with minimal tweaks. Instead of dealing with partial compatibility or custom precompiles, developers bring their repos, test suites, and CI pipelines as-is. This lowers learning curves, prevents audit drift, and shortens delivery times. For users, equivalence translates into faster app coverage: wallets, explorers, and analytics tools work right away, so the ecosystem feels familiar from day one. In short, Taiko meets builders where they already are.

ZK Rollups in a Nutshell

A ZK rollup executes many transactions off-chain (or off-Layer-1), compresses the results, and submits a validity proof to Ethereum. The proof is like a math receipt that convinces Ethereum the new state is correct, without replaying every step. Because Ethereum validates the proof, users do not need to trust external actors blindly. This approach reduces on-chain data, lowers costs, and shortens confirmation times while keeping strong security. Over time, improvements in provers and circuits further cut latency and gas, making ZK rollups attractive for both DeFi power users and newcomers seeking smoother UX.

Who Is Taiko For?

Taiko targets two audiences at once. For users, it promises low-friction transactions, clearer fees, and access to familiar Ethereum apps with less waiting. For developers, it offers an almost drop-in environment where existing Solidity code, tooling, and audits remain valid. This dual focus matters because networks grow when both sides succeed: builders can ship confidently, and users can interact without re-learning everything. If you want Ethereum’s security with a faster, cheaper feel—and without abandoning the ecosystem—Taiko is designed with you in mind.

How Taiko Works—Architecture, Proofs, and Data

Under the hood, Taiko batches transactions, executes them in a Layer-2 environment, and then posts necessary data to Ethereum for availability. A prover system generates ZK validity proofs that attest the batch was executed correctly. Meanwhile, the sequencer orders transactions to keep the network responsive. Finally, Ethereum verifies proofs and anchors the canonical state. Because data availability is on Ethereum, anyone can reconstruct the chain, which supports neutrality and auditability. The result is a secure pipeline: rapid execution on L2, cryptographic proofs for correctness, and Ethereum as the final court of record.

Sequencers and Provers: A Simple Flow

First, a sequencer collects user transactions and arranges them into blocks for fast UX. Next, execution occurs and a prover builds a succinct cryptographic proof that the state transition is valid. This proof, plus compacted data, is sent to Ethereum. Once verified, the rollup’s new state becomes final. Importantly, Taiko’s roadmap points toward more decentralization of these roles over time, so ordering and proving are not bottlenecked by a single party. For users, this flow feels like quick confirmations on L2 followed by robust finality on L1.

Validity Proofs vs. Fraud Proofs

Optimistic rollups rely on fraud proofs and challenge windows, meaning withdrawals can take days to finalize. ZK rollups rely on validity proofs, which mathematically certify correctness at submission. This difference often leads to faster settlement for bridging and fewer edge cases during high-volatility periods. While each design has trade-offs, ZK systems shine where fast finality and predictable exits matter. For traders, creators, and builders, this lowers operational friction, reduces stuck funds, and improves composability with the broader Ethereum stack.

Why Data Availability on Ethereum Matters

Putting data on Ethereum ensures anyone can rebuild Taiko’s state if needed. This is crucial for censorship resistance, neutrality, and long-term resilience. Even if off-chain services fail, the data root lives on L1, so independent clients can verify, reconstruct, or fork with confidence. Practically, that makes the network transparent, auditable, and safer for value-bearing apps. For enterprises and institutions, it also simplifies risk reviews, because Ethereum’s durability and track record support long-term assurances.

Getting Started—Wallets, Bridges, and First Transactions

Onboarding should feel simple. Start with a mainstream wallet that supports EVM networks. Add Taiko’s network settings or use an official link to inject RPC details safely. Fund the wallet with a small amount of ETH on the origin chain, then use a reputable bridge to move funds to Taiko. Begin with tiny test transfers; confirm arrival, check fees, and try a simple swap or mint. As you gain confidence, scale your activity gradually. Because Taiko is EVM-equivalent, many dApps you know will work similarly, so the learning curve stays light.

Wallet Setup with Safety in Mind

Pick a well-known wallet and keep seed phrases offline. Verify Taiko RPC endpoints from trusted documentation and avoid random pop-ups that ask for approvals. Enable phishing protection and consider a hardware wallet once balances grow. Before signing, read messages: grant only the permissions you need, and periodically revoke old approvals on explorers. Small habits—like bookmarking official URLs—prevent large mistakes. This is the simplest way to enjoy lower fees without compromising security.

Bridging Assets Without Stress

Use verified bridges or official portals. Start with a nominal amount to confirm routes, fees, and timing. Some bridges provide fast exits; others prioritize low cost. Choose based on your needs, and remember that speed often trades with price. Keep screenshots of TX IDs and store them in a note for quick support if needed. If a transaction is delayed, avoid panic and check explorer status first; many hiccups resolve automatically within minutes.

Fees, Confirmations, and Daily Usage

Expect fees to be significantly lower than mainnet, especially during busy hours. However, fees can still vary with demand. If a transaction seems slow, a modest fee bump usually helps. For daily activity—swaps, stake/unstake, or mints—batch operations when possible and avoid peak windows tied to major market events. Over time, you will form a rhythm: small, frequent interactions for exploration and occasional larger ones once trust is established.

Building on Taiko—Tools, Deployments, and Testing

Developers can bring familiar stacks—Hardhat, Foundry, Truffle, and common libraries like OpenZeppelin—and deploy with minimal changes. Start by pointing your toolchain to Taiko’s RPC, running unit tests, then performing a small canary deployment. Because Taiko aims for bytecode-level equivalence, debugging flows feel nearly identical to Ethereum. For serious projects, treat L2 with production discipline: CI pipelines, staged rollouts, canary users, robust logging, and observability dashboards. When you reduce surprises in staging, mainnet launches feel boring—in the best way.

Tooling That Just Works

Equivalence means compilers, debuggers, and test frameworks behave predictably. You can reuse scripts for deployments, verifications, and admin tasks. Most explorers support contract verification from the same metadata, so public transparency remains strong. Use gas reporters to compare costs across chains and identify hot paths to optimize. With familiar tooling, teams spend time on features rather than fighting edge-case differences.

Deployment Patterns That Reduce Risk

Adopt well-understood patterns: upgradeable proxies when needed, pause and rate-limit switches for emergencies, and multi-sig or timelock governance for changes. Keep admin keys in hardware wallets and document incident playbooks. Stage your rollout: deploy core contracts, test with allowlists, and expand once metrics look healthy. Transparency—publishing addresses, audits, and docs—earns community trust and reduces confusion.

Testing for Parallel Users and Real Traffic

Simulate concurrent users with scripts that submit overlapping actions, then inspect for race conditions and re-entrancy risks. Add property-based tests that fuzz inputs to reveal failure modes you did not anticipate. Track time-to-finality, reorg sensitivity, and oracle behaviors under load. Capture logs during peak events and review them weekly. These habits prevent most production fires and convert launch week anxiety into ordinary engineering.

Security, Assurances, and Practical Trade-Offs

Taiko inherits settlement security from Ethereum by publishing data and verifying proofs on L1. Still, every system has trade-offs: sequencer neutrality evolves over time, prover performance improves iteratively, and bridging layers add complexity. Treat security as a practice, not a checkbox. Favor audited code, conservative risk parameters, and clear incident processes. For users, prefer well-documented apps and keep approvals tight. For teams, invest in monitoring, bug bounties, and dependency reviews. Safety compounds the same way revenue does—one careful release at a time.

Ethereum as the Final Arbiter

Because proofs land on Ethereum, Layer-1 ultimately decides what state is valid. This anchors Taiko to a battle-tested base, which is reassuring for value-bearing apps. If off-chain services fail, the data exists on L1, so independent verifiers can rebuild or challenge assumptions. For treasuries and institutions, this connection to Ethereum reduces model risk and simplifies internal approvals.

Decentralization and the Road Ahead

Healthy networks broaden participation. Over time, expect more diverse sequencing and proving, expanded validator/custodian options, and stronger community oversight. Open metrics and public roadmaps help outsiders audit progress. The destination is simple: fewer single points of failure and more transparency around who does what. As decentralization deepens, user confidence rises naturally.

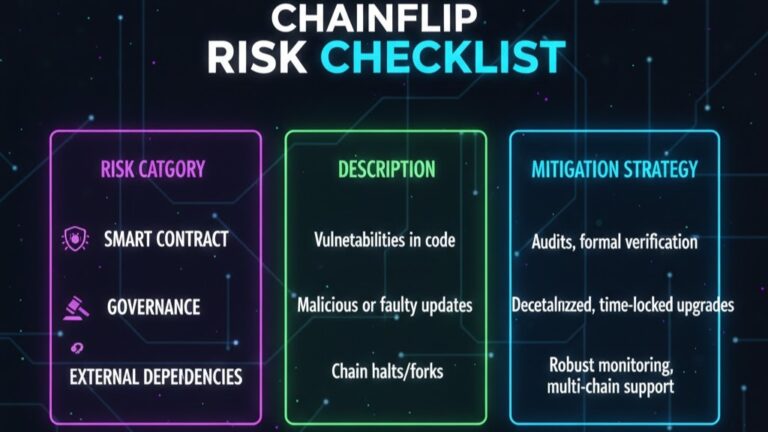

Risk Management for Users and Builders

Users should routinely revoke stale token approvals, split funds across wallets, and keep backups offline. Builders should monitor attack surfaces: admin keys, price feeds, upgrade paths, and external dependencies like bridges. Publish runbooks for outages, simulate chaos drills, and keep an emergency communications plan. Prepared teams recover quickly and retain trust—even when the unexpected happens.

Use Cases That Shine—DeFi, NFTs, Gaming, and More

Because Taiko reduces costs while preserving Ethereum compatibility, common use cases become smoother. DeFi protocols can offer tighter spreads and more frequent compounding. NFTs and gaming gain from cheaper mints and fluid microtransactions. Creator and social apps benefit from fast tips, gated content, and reputation tokens. For everyday users, these improvements turn on-chain actions from “special events” into daily routines—tap, confirm, done. A familiar stack plus better UX is how mainstream adoption happens.

DeFi That Feels Practical

On L2, swaps, LP shifts, and strategies can run without gas anxiety. Protocols can design features that were cost-prohibitive on L1, like fine-grained rebalancing or frequent vault harvests. With finality anchored to Ethereum, risk frameworks remain understandable. As liquidity migrates, expect more diverse markets and incentives that reward real usage, not just mercenary farming.

NFTs and Games with Lower Friction

High mint fees break immersion and throttle creativity. On Taiko, creators can experiment: free mints, dynamic metadata, or in-game items that move quickly between players. For studios, cheaper on-chain actions unlock richer mechanics—daily quests, item crafting, or ticketing—without scaring users. The result is a more playful, accessible ecosystem that welcomes casual audiences.

Payments, Social, and Creator Tools

Micropayments and subscriptions make sense when fees are tiny and finality is quick. Creators can gate content, send rewards, or run loyalty programs without clunky custodial workarounds. Social apps can anchor identities and achievements on-chain while keeping interactions snappy. When money moves smoothly, communities grow naturally, and value remains user-aligned.

Costs, Performance, and Everyday UX

Performance is not just TPS; it is how reliably the system feels during real life. Taiko’s design aims to keep confirmations predictable and fees reasonable, even when markets are busy. For users, the playbook is simple: transact slightly off-peak, batch actions when possible, and keep a small buffer of gas. For teams, profile hot paths, pre-compute where you can, and cache reads. Smooth UX comes from many small choices that add up.

Gas, Throughput, and What to Expect

Fees fluctuate with demand, but L2 economics typically beat L1 by a wide margin. Expect modest costs for basic actions and more comfortable fees for complex calls. When airdrops or mints spike activity, patience helps. Most congestion resolves quickly, and small fee bumps clear transactions without stress. Track explorer stats to learn local rhythms.

UX Tips That Reduce Abandonment

Write clear button text, show progress steps, and confirm success with next actions. Offer “quick actions” for newcomers—small swaps, simple mints, or faucet links—so first value appears fast. Keep error messages human: say what happened, why, and how to fix it. These details increase completion rates and make your product feel considered.

Comparing Taiko to Other L2s

Different L2s optimize different trade-offs—proof systems, decentralization timelines, or fee structures. Taiko’s selling point is EVM equivalence with ZK proofs anchored to Ethereum. Some peers favor optimistic windows; others add custom features. The best choice depends on your priorities. Fortunately, users can try many networks with the same wallet and pick what feels right.

Roadmap Signals—How to Follow, Learn, and Start Today

As Taiko evolves, watch practical indicators: stable mainnet ops, growing active users, more audited dApps, and steady tooling support. Follow official channels for network parameters, upgrades, and security notes. For learners, start tiny: add the network, bridge a small amount, and complete one safe transaction. For builders, port a small contract, verify it, and gather feedback from a small cohort. Momentum compounds through consistent, measured steps.

What to Watch in the Next 90 Days

Look for dashboards showing daily active users, TVL trends, and bridge volumes. Track sequencer/prover decentralization milestones and client diversity. Monitor grant programs, hackathons, and new integrations with wallets, oracles, and indexers. These signals separate short-term hype from durable progress and help you plan with confidence.

Join the Community and Builder Programs

Healthy ecosystems thrive on collaboration. Join forums, Discords, or dev calls to share feedback and get early answers. If you are shipping something useful—tooling, SDKs, tutorials—consider grants or sponsorships. Publicly documenting lessons builds your reputation and accelerates others. Communities remember who helped early.

Your 7-Day Starter Checklist

Day 1: add network and secure your wallet. Day 2: bridge a small amount. Day 3: try a swap and revoke approvals you do not need. Day 4: mint a test NFT or join a safe vault. Day 5: document costs and timings. Day 6: explore two new dApps. Day 7: write a short post—what worked, what didn’t, and what you will try next.