Merlin Chain (MERL): What Makes This Bitcoin L2 So Unique

Merlin Chain (MERL) is a fast, secure Bitcoin Layer-2 enabling smart contracts, lower fees and scalable dApps on Bitcoin with a modern developer-focused design.

By Yaser | Published on November 21, 2025

What Merlin Chain Is — A plain-language introduction

Merlin Chain positions itself as a Layer-2 protocol built to extend Bitcoin’s utility beyond simple value transfer. In plain terms, Merlin brings smart-contract capabilities, faster finality, and lower per-transaction costs to the Bitcoin ecosystem while anchoring settlement security to Bitcoin’s base layer. It aims to let developers deploy contract logic and decentralized applications that interoperate with Bitcoin’s store of value without forcing users or builders to accept slow, expensive base-layer fees. By combining off-chain execution techniques with periodic on-chain settlement, Merlin seeks to offer a pragmatic bridge: keep Bitcoin’s security guarantees while enabling modern dApp patterns—payments, lending, tokenized assets, and lightweight programmability—that were previously hard or costly to run on Bitcoin directly.

Core idea simplified

Merlin separates execution from settlement: transactions execute on a fast Layer-2 network while concise settlement proofs anchor outcomes to Bitcoin. Conceptually, this means users enjoy quick confirmations and cheap interactions, but the immutable Bitcoin ledger remains the ultimate reference. For everyday users, that translates into responsive apps and fewer surprise fees; for institutions, it offers a clearer audit trail and custody model consistent with Bitcoin’s conservative trust assumptions.

Target audiences and practical value

Merlin is aimed at builders who want Bitcoin as collateral or settlement, traders who want low-cost microtransactions, and businesses seeking payment rails anchored to the world’s most trusted asset. It also appeals to Bitcoin maximalist developers who want composability without moving to completely different ecosystems. In practice, the chain may be used for settlements, payment channels, and simple financial primitives that benefit from Bitcoin’s liquidity and brand, while avoiding heavy on-chain costs.

High-level tradeoffs to expect

Any Layer-2 design involves tradeoffs: execution speed, finality models, and complexity of proofs versus developer ergonomics and decentralization. Merlin’s goal to favor Bitcoin anchoring means occasional waits for final settlement on mainnet while still offering fast provisional confirmations. Users should expect better UX than raw Bitcoin transactions but should still respect the conservative risk model: ultimate finality follows Bitcoin, and off-chain mechanisms require careful monitoring and reliable operator incentives.

Architecture & Mechanics — How Merlin actually works

Merlin’s architecture typically combines an execution layer, an ordering/sequencing component, and a settlement bridge that posts periodic state commitments to Bitcoin. Execution can occur in optimistic or validity-proof styles; many Bitcoin L2 designs favor compact on-chain proofs or checkpointing to minimize Bitcoin fees. The sequencer orders transactions for throughput; a prover or challenge period then ensures correctness before commitments lock to Bitcoin. Data availability choices—whether stored on-chain, via external DA layers, or via dedicated relays—critically shape censorship resistance and recovery options. Combined, these components let Merlin run high-volume transactions while keeping the cost of anchoring minimal and predictable.

Sequencing and ordering explained

A sequencer collects user transactions and produces ordered blocks for fast execution. Because ordering affects MEV and fairness, robust Merlin designs either decentralize sequencing over time or formalize fair ordering rules. Sequencers may run as permissioned nodes early on, then open to a broader set of operators. Users benefit from immediate inclusion and quick responses while the protocol manages longer-term decentralization roadmaps to reduce centralized risks.

Settlement: anchoring to Bitcoin

Periodically, Merlin publishes compact commitments—hash roots or succinct proofs—to Bitcoin transactions. These on-chain anchors provide an immutable reference that any observer can use to verify L2 state history. Anchoring frequency balances cost and security: more frequent anchors lower finality lag but increase Bitcoin fees. Merlin designs often allow light clients or relayers to reconstruct state from anchors plus off-chain data, enabling trustless recovery if L2 services fail.

Data availability & recovery

Data availability (DA) determines whether anyone can rebuild the L2 if operators vanish. Merlin may rely on on-chain publication of minimal data, external DA providers, or distributed storage networks. Strong DA reduces reliance on custodial relays but can be more expensive. Good L2 designs include recovery paths—procedures to reconstruct user balances from anchors plus submitted proofs—so users retain access even during outages. This balance between cost and resilience is central to Merlin’s practicality.

Onboarding users — wallets, bridging, and first steps

To use Merlin, users typically add the network to an EVM-compatible or Bitcoin-aware wallet that supports the chain’s account model. Bridging flows vary: some solutions lock BTC or tokenized representations in custody while minting corresponding assets on Merlin, others use cross-chain swap primitives or peg-mechanisms with monitored custodians. New users should start with small transfers, verify transaction receipts, and check bridge confirmation policies. Because the ecosystem is emerging, prefer official bridges or audited third-party gateways, and enable safety features like hardware wallets. Clear tutorials, vetted explorer links, and small test transactions remove anxiety and help users build fluency.

Wallet compatibility and recommended setup

Merlin may support custom RPC endpoints or integrate into multi-chain wallets with simple network import steps. Use well-known wallets that allow manual RPC addition and support hardware signing. Always verify RPC details from official documentation, store seed phrases offline, and keep a recovery checklist. For significant funds, use cold storage and only move amounts necessary for active trading or dApp interaction. Small daily balances reduce exposure while you learn the network’s rhythms.

Bridging patterns and safety

Bridges can be custodial, federated, or trustless; choose based on your risk tolerance. Custodial bridges are fast but involve counterparty risk, while trustless bridges use cryptographic proofs or multi-party consensus to reduce trust. Always check bridge audits, withdrawal windows, minimums, and fees. Start with a nominal transfer, confirm receipt on Merlin, and test reverse withdrawals where possible. Keep transaction logs and support contacts handy if any discrepancies arise.

First transactions and simple dApp interactions

After bridging, try a small swap or a basic on-chain action (e.g., a micro-mint or token transfer). Note actual gas costs and confirmation times to calibrate expectations. If interacting with a dApp, review permissions and revoke excessive approvals afterwards. Many early networks offer faucets or testnets; use them first to learn flows without deploying real capital. Document your steps to help other users and to speed future onboarding.

Developer experience — tooling, deploying, and best practices

Merlin’s success hinges on developer ergonomics. Ideally, teams can reuse familiar toolchains—Solidity, Hardhat, Foundry—plus standard libraries like OpenZeppelin. A friendly RPC, robust testnets, documentation, and verified explorers accelerate adoption. Developers should follow best practices: write modular contracts, include upgradeability and pause controls where appropriate, and maintain comprehensive test suites that simulate cross-chain behaviors. Integration tests must cover bridging, reorg scenarios, and recovery paths. By reducing friction, Merlin invites more dApps and tools, which in turn increases liquidity and user choice.

Recommended local and CI workflows

Set up local forks of Merlin testnets for deterministic debugging. Use CI to run unit, integration, and fuzz tests on every commit. Automate contract verification and gas profiling, so cost impacts are visible early. Maintain a staging deployment exposed to a small set of testers before mainnet release. Consistent pipelines reduce release stress and improve auditability for security teams and external reviewers.

Patterns for cross-chain interactions

Design contracts with clear interfaces for cross-chain messaging: input validation, idempotency, and retry logic. Implement nonces or unique identifiers for cross-chain events to avoid double-processing. Use trusted relayers where necessary, but keep modular hooks to allow migration to decentralized relayer networks. Document failure modes and provide tooling to reconcile states when messages are delayed or reordered.

Observability and monitoring

Instrument contracts and services with logs, metrics, and alerts for unusual rates, failed proofs, or bridge bottlenecks. Expose dashboards tracking queue lengths, anchoring latency, and prover throughput. Observability helps identify congestion early and supports healthy ops: faster incident response, informed parameter tuning, and transparent post-mortems that build community trust.

Practical use cases — payments, DeFi primitives, and beyond

Merlin enables practical applications previously awkward or costly on Bitcoin. Use cases include micro-payments and tipping, high-frequency settlement for merchants, trust-minimal escrow and peer-to-peer lending, and tokenized representations for real-world assets secured by Bitcoin settlement. NFT ecosystems and gaming economies can run cheaper mints and fast marketplace interactions. Because Merlin anchors to Bitcoin, it becomes attractive for services that want Bitcoin-denominated value while providing modern UX—examples include paywalls, streaming micro-transactions, and stable value rails for emerging markets.

Payment rails and merchant integrations

Merlin’s low fees and quick confirmations make it suitable for merchant payments and micropayments where Bitcoin mainnet costs would be prohibitive. Integrations can provide instant provisional credit while awaiting Bitcoin settlement. This enables new business models—metered content, per-second streaming, or microdonations—that benefit creators and small merchants without banking intermediaries.

DeFi building blocks on Merlin

Lending pools, automated market makers, and yield aggregators can operate more efficiently on Merlin due to lower gas friction. Protocol designs should consider collateral models anchored in Bitcoin value and adapt liquidation mechanisms to cross-chain delays. Well-designed risk engines and guarded oracle setups are crucial to manage price feeds and avoid cascading failures.

NFTs, gaming economies, and tokenized assets

Game economies need cheap state changes for item trades, upgrades, and events; Merlin can host these affordably. NFTs benefit from lower minting costs and faster marketplace interactions. Tokenized real-world assets—bonds, invoices, or stable instruments—can gain from Bitcoin-anchored settlement that institutions find familiar, bridging TradFi and crypto use cases.

Security model, audits, and operational risks

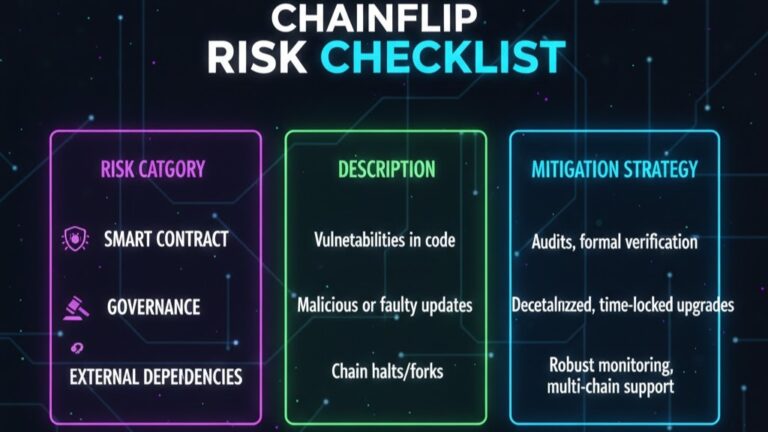

Merlin’s security derives from a layered model: robust off-chain execution practices, cryptographic commitments to Bitcoin, and operational safeguards like multisig control and audited contracts. However, L2s introduce new attack surfaces: buggy relayer logic, sequencer manipulation, bridge exploits, and misconfigurations. Continuous audits, public bug bounties, formal verification for critical modules, and transparent upgrade processes are essential risk mitigants. Users and integrators should understand the network’s slashing, dispute, and rollback mechanics, and follow conservative custody practices until the ecosystem proves long-term resilience.

Common L2 attack vectors and mitigations

Attack vectors include bridge thefts, faulty sequencer logic, oracle manipulation, or prover failure. Mitigations: multi-party custody, audited bridge contracts with timelocks, decentralized sequencing roadmaps, and redundant oracle feeds. Maintain rigorous access controls and fast incident response playbooks. Regularly test recovery scenarios and ensure the community understands how to withdraw or reconcile funds if operators act maliciously.

Importance of independent audits and bug bounties

Third-party audits expose design flaws and improve system hardening. Bug bounty programs reward responsible disclosure and attract security researchers. Audits should be public, and findings tracked with remediation timelines. Continuous security posture — not one-time checks — creates confidence for institutional users and signals maturity to partners evaluating integration risk.

User best practices to reduce exposure

Users should minimize bridge volumes, use hardware wallets for keys, verify contract addresses, and separate funds between active wallets and cold storage. Revoke unused approvals, monitor contract changes, and keep communications channels for official security notices. Conservative behavior—small steps, careful confirmations—reduces losses while the network matures.

Economics & governance — tokens, incentives, and sustainability

A sustainable Merlin ecosystem aligns incentives across sequencers, provers, validators, and users. Token models (if present) typically fund security, pay operators, and steer governance. Fee models should balance affordable user experience with sufficient operator compensation to attract decentralized infrastructure. Governance mechanisms—on-chain voting, timelocks, and multisig treasuries—help coordinate upgrades while limiting abrupt changes. Long-term success depends on predictable economics, transparent allocation of funds (grants, development, insurance), and policies that favor ecosystem growth without over-diluting stakeholders.

Fee design and operator rewards

Fees pay for sequencing, proving, and anchoring. A predictable fee schedule reduces user confusion and helps builders estimate costs. Operator rewards must be competitive relative to infrastructure costs; otherwise decentralization stalls. Fee rebates or subsidized bootstraps may jumpstart activity but should phase out to reveal true economics that sustain validators and provers.

Governance patterns for resilient upgrades

Governance needs to be transparent and deliberate: proposals, review windows, and staged rollouts reduce risk. Community representation, developer councils, and independent auditors for major upgrades increase trust. Timelocks and upgrade pauses allow detection of harmful proposals. Good governance balances agility with safety to maintain community confidence and institutional engagement.

Grants, ecosystem funding, and developer incentives

Active grant programs and hackathons attract builders. Funding should prioritize infrastructure—wallet integrations, bridges, observability—rather than speculative token pumps. Clear criteria for grants, measurable milestones, and open reporting increase program effectiveness. Long-term funding mechanisms (protocol fees, foundation endowments) support maintenance and tooling that power sustainable adoption.

How to watch Merlin’s progress — signals that matter

Track objective metrics: mainnet uptime, bridge volumes, daily active users, TVL (if relevant), and number of audited dApps. Monitor decentralization milestones—sequencer and prover diversity—and community governance activity. Look for growing tooling: wallet integrations, indexed data providers, and robust explorer coverage. News about major partnerships, institutional use-cases, or compliance clearances indicate real adoption. Lastly, examine developer activity on repos and grant awards—sustained contributions usually predict long-term growth better than price spikes alone.

Short-term signals to watch

Watch anchor frequency and anchor success rates, bridge withdrawal times, and any incident reports. Rising on-chain transaction counts with stable fees suggest organic usage. Rapidly expanding merchant integrations or pilot programs with payment processors are also strong adoption signals.

Medium-term indicators

Look for an expanding suite of audited dApps, wallet and explorer support, and progressive decentralization of sequencers and provers. Increasingly automated tooling, SDKs, and monitored CI pipelines for smart contracts indicate the ecosystem is maturing for real projects.

Long-term health metrics

Long-term success shows in sustained active user cohorts, predictable economics, wide operator participation, and institutional integrations that persist through market cycles. A healthy protocol will demonstrate continuous upgrades, transparent governance, and an ecosystem where builders and users return because the product works reliably—not because of speculative incentives.