New FSB Report Exposes Flaws in Crypto Oversight

The FSB’s new report reveals deep flaws in global crypto rules, warning investors as regulators struggle to align oversight and protect financial stability.

By Yaser | Published on October 25, 2025

What the New FSB Report Actually Says—and Why It Matters

The Financial Stability Board (FSB) just released a thematic peer review of how countries are implementing its 2023 global framework for crypto and stablecoins. In short, the FSB finds “significant gaps and inconsistencies” across jurisdictions. That matters because crypto is borderless; when rules differ, firms can jurisdiction-hop, data gets fragmented, and oversight becomes harder just when market size and complexity are growing. For readers of GrindToCash, this is not abstract policy talk—it affects liquidity, risk, and how quickly institutions scale back into crypto in 2025–2026.

Who Is the FSB and What Is Its Mandate?

The FSB is the G20’s global watchdog for financial stability. It doesn’t pass laws, but its standards steer national regulators and central banks. When the FSB says implementation is uneven, it’s signaling that the plumbing beneath the market—licensing, supervision, cross-border cooperation—still isn’t aligned. That misalignment creates blind spots during stress, exactly when regulators need consistent data and tools. For investors, FSB reports are early warning systems: they tell you where systemic risks might build even before prices move.

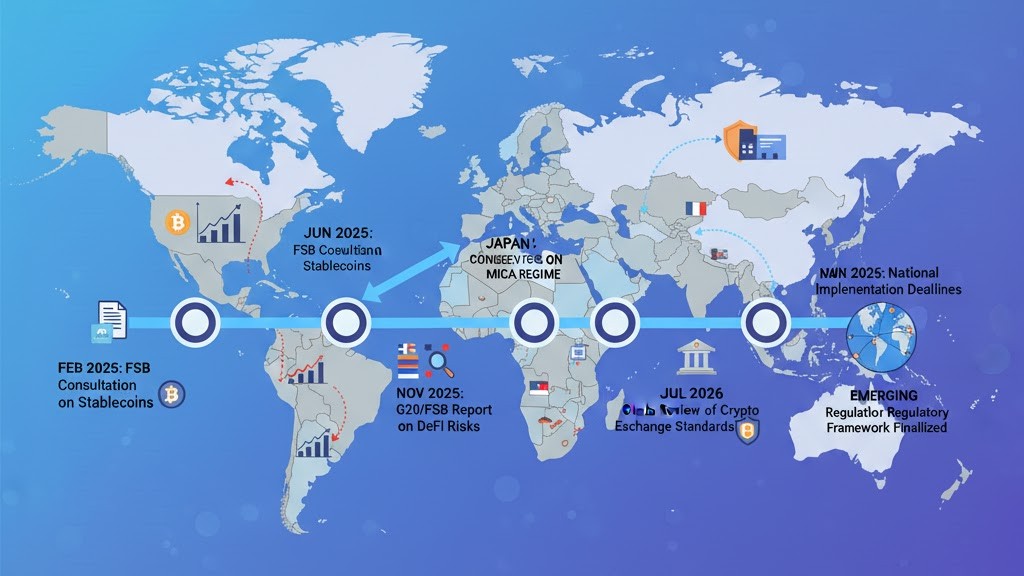

What Was in the 2023 Framework?

In July 2023, the FSB finalized two pillars: recommendations for crypto-asset activities and markets, and high-level recommendations for global stablecoin arrangements. Together, they push for consistent licensing, robust risk management, better data reporting, and cross-border coordination—especially for stablecoins that could impact payments and money markets. The 2025 peer review is a check-in: have countries actually implemented those recommendations? The answer, according to the FSB, is not uniformly—and that’s the core problem.

What Did the 2025 Peer Review Examine?

The FSB assessed progress on CASP (crypto-asset service provider) oversight, stablecoin frameworks, data/reporting, and cross-border cooperation. It also looked at how implementation gaps enable regulatory arbitrage when activity shifts to lighter-touch jurisdictions or offshore venues. The review flags both policy and operational shortfalls: not only are some rules missing, but supervisory capacity and data are often inadequate to monitor risks in real time. This is the backbone of the latest warning.

The Core Finding—Gaps and Inconsistencies Create Real Market Risk

The headline: global implementation is uneven. When different countries apply different rules at different speeds, crypto firms can route activity through lenient hubs, complicating enforcement and surveillance. The FSB explicitly warns that this fragmentation raises the odds of missed risks, messy responses to stress, and slower institutional adoption. News outlets echo the point: the market has grown fast, yet many jurisdictions lag on stablecoin and CASP rules. For investors, this translates into policy-driven volatility and jurisdiction risk that can hit prices without warning.

Stablecoin Frameworks Are Still Lagging

Despite stablecoins’ growing scale, few countries have comprehensive, enforceable regimes that cover issuance, reserves, redemption, and disclosure end-to-end. This matters because stablecoins often act like crypto’s funding pipes. If legal clarity is thin—or fragmented—depegs, redemptions, or bank-run dynamics can spill over into broader markets. The FSB’s 2025 review stresses that alignment is the goal; until then, investors should assume higher headline risk around stablecoin policy and enforcement actions.

CASP Licensing and Supervision Remain Incomplete

The peer review highlights gaps in licensing and supervision of exchanges, brokers, custodians, and lenders. When CASPs operate across borders with inconsistent requirements, data quality and enforcement reach suffer. That can distort reported liquidity, complicate market surveillance, and heighten counterparty risk. Practically, this means your trading venue’s legal status and supervisory regime matter as much as its fees. Choose regulated venues with transparent audits and clear client-asset protections.

Cross-Border Cooperation and Data Are Still Weak

The report calls out coordination and data-sharing as structural pain points. Without consistent reporting, regulators can’t stitch together a full picture, especially when activity sits offshore or on less transparent venues. The FSB urges stronger cooperation mechanisms and standardized data to reduce blind spots. Until that improves, investors should expect surprise headlines as local actions ripple globally, sometimes with outsized price effects.

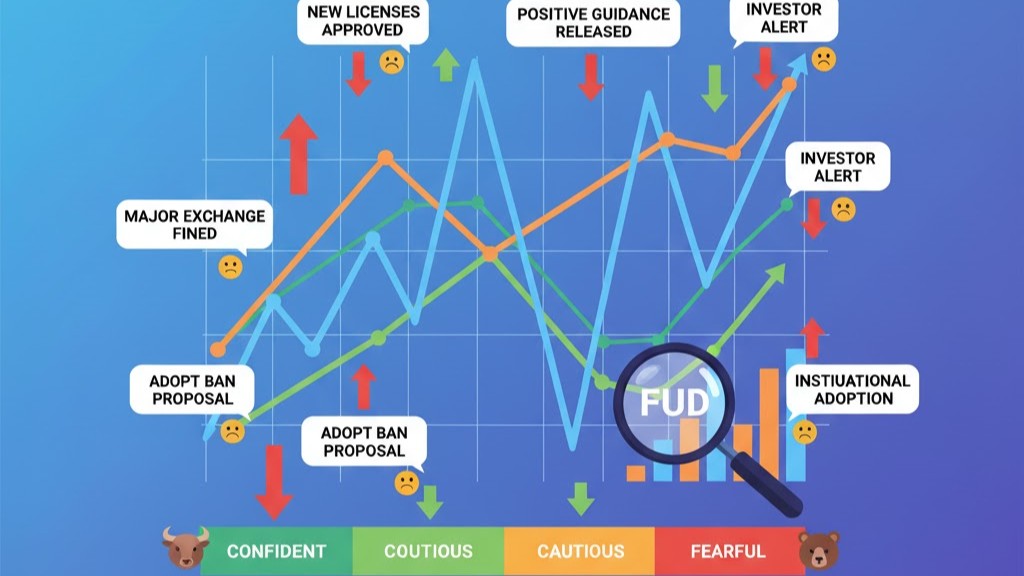

How This Can Move Prices—Transmission Channels to Watch

Implementation gaps directly influence risk premia in crypto. When regulators send mixed signals, spreads widen, liquidity thins during stress, and large players slow deployment. The FSB’s timing is important too: headlines about regulatory arbitrage tend to coincide with spikes in policy uncertainty, a known driver of volatility. Media coverage underlines the same theme: fragmentation can shake confidence, especially in instruments linked to payments and settlement. For GrindToCash readers, treating policy risk like a market variable is now non-negotiable.

Investor Positioning—Why Caution Can Become a Feedback Loop

When rules look uncertain, funds shift toward higher-quality venues, larger caps, and more transparent stablecoins. That defensiveness can amplify rotations and dominance shifts even without fresh macro data. In the short term, this may look like “risk-off” in alts; in the medium term, it can slow on-ramps as compliance teams wait for clearer guidance. Knowing this, traders can plan around headline windows and avoid over-sizing positions into regulatory events.

Stablecoin Stress as a Volatility Catalyst

Because stablecoins act like market plumbing, any policy shock that questions reserves, redemption rights, or disclosures can widen basis, hit funding, and raise hedging costs. Even rumors can increase redemption demand. Until more jurisdictions finalize comprehensive rules, assume episodic spikes in stablecoin-related news risk. Diversifying on-ramp/off-ramp options and monitoring issuer communications are practical defenses.

Institutional Timelines and Liquidity Cycles

Large institutions care about regulatory certainty. If the FSB says implementation is lagging, committees read that as “more work before scaling.” This doesn’t kill long-term adoption, but it stretches timelines. The impact is subtle: liquidity looks fine in calm weeks, then shrinks faster during stress because fewer balance sheets are active. Plan for that asymmetry with position sizing and staggered entries.

What It Means for Exchanges, Issuers, and DeFi Builders

For exchanges and brokers (CASPs), the takeaway is: strengthen licensing footprints and evidence of segregation/custody. For stablecoin issuers, align with the toughest reserve and disclosure norms you can reasonably meet—waiting for every country to harmonize is risky. For DeFi teams, expect more scrutiny on bridges, oracles, and cross-chain flows where oversight gaps are largest. Teams that treat compliance as a product feature will win listings, partnerships, and institutional flow sooner.

Exchanges—Proofs, Audits, and Jurisdiction Strategy

Build redundant compliance: where possible, hold licenses in major hubs, publish independent attestations, and explain client-asset protections in plain English. When rules evolve, exchanges with modular compliance can adapt without delisting half the market. Users should reward venues that invest here; those safeguards are worth more than a tiny fee discount during stress.

Stablecoin Issuers—Reserves and Redemption Discipline

Issuers should adopt reserve practices that withstand multi-jurisdictional scrutiny. That means frequent disclosures, clear redemption windows, and diversified custody. If your communications are proactive, regulators and institutions gain confidence even before laws finalize. For users, watch reserve transparency, attestor quality, and issuer responsiveness during market noise.

DeFi—Bridges, Oracles, and Cross-Border Risk

DeFi isn’t exempt. The FSB highlights cross-border supervisory limits; that’s exactly where bridges and oracles live. Builders should adopt clear disclosure norms, minimize upgrade keys, and document incident response. Users should favor protocols with battle-tested bridges, transparent governance, and audit histories. Stronger self-regulation today can mean smoother integration with regulated rails tomorrow.

Policy Divergence—Why One Country’s Rules Move Another’s Market

Coverage of the FSB review notes a patchwork: some jurisdictions push forward, some hold back, and some take very different approaches. This divergence enables regulatory arbitrage, where providers base operations where requirements are lightest—even though their user base is global. The FSB warns that this reality complicates supervision and can transmit shocks across borders. For investors, country headlines you don’t trade in can still reprice your portfolio.

The Arbitration Effect—How Activity “Leaks” Offshore

When rules tighten in one hub, activity may leak to offshore venues. That doesn’t remove risk; it concentrates it where transparency and cooperation are weaker. The FSB’s call is to close leaks via aligned rules and better cooperation. Until then, assume that “out of sight” doesn’t mean “gone”—it means harder to monitor and faster to surprise.

Why Data Fragmentation Matters

If each jurisdiction collects different data—or collects it on different timelines—authorities can’t see stress building until it’s already systemic. For markets, that means sharper moves when new information finally lands. The FSB is pressing for standardized reporting and information sharing to reduce lag and blind spots. Investors can mimic that mindset by diversifying data sources, not relying on a single dashboard.

Reading Headlines Through a Global Lens

A domestic policy story can trigger global repricing if it touches dollar rails, stablecoins, or major venues. The practical lesson: read policy news outside your home market, because capital is mobile even if rules aren’t. That’s how you spot contagion channels before they hit prices. Keeping a watchlist of key jurisdictions and regulators is now part of good crypto hygiene.

Timelines and Next Steps—What Happens After This Review

The FSB’s latest review is not the end; it’s a checkpoint to accelerate implementation. Expect more coordination pushes and follow-ups aimed at closing gaps, especially in stablecoin rules and CASP supervision. The message to authorities is to move faster together; the message to markets is to price the speed of convergence. If alignment improves, headline risk fades and institutional participation normalizes. If not, fragmentation risk stays in the price.

How to Track Real Progress

Watch for formal proposals, consultations, and rulemakings in major hubs that reference FSB language. Then look for implementation evidence: licensing regimes going live, enforcement synchronized across borders, and standardized reporting rules. These are tangible signals that policy risk is declining, not just being discussed.

The Role of Other Standard-Setters

The FSB isn’t alone. The Financial Action Task Force (FATF) keeps pushing countries to implement AML/CFT standards for crypto. When FATF and FSB messages rhyme—“close gaps, align rules, share data”—that’s a convergence cue. As more jurisdictions comply, the market structure becomes sturdier and less vulnerable to illicit-flow or disclosure shocks.

What “Good” Looks Like by 2026

A healthier 2026 landscape would feature comprehensive stablecoin laws, licensed CASPs in major hubs, standardized reporting, and operational cooperation across borders. That’s when institutional adoption can scale without policy overhang. Until then, treat this period as transition: opportunities are real, but so are the policy curves to navigate.

A Practical Playbook for GrindToCash Readers

Policy risk is manageable when you treat it like any other market variable. Build routines that assume headlines will hit. Choose venues with strong licensing, diversify stablecoin exposure, and size positions so a policy shock doesn’t force bad exits. For builders and treasuries, align internal standards with the strictest credible regime you operate in. This “compliance-first” mindset costs less than firefighting after the fact—and it signals quality to partners, banks, and institutions. (Educational content, not investment advice.)

Venue and Counterparty Checklist

Prefer exchanges that publish independent attestations, detail client-asset segregation, and hold licenses in widely respected jurisdictions. For custody, look for insurance disclosures and SOC reports. Avoid thin-liquidity pairs on unverified venues—policy shocks often widen spreads and magnify slippage there. These choices reduce operational and headline risk before it happens.

Stablecoin Diversification and Monitoring

Use more than one stablecoin, and monitor reserve disclosures and issuer communications. Track on-chain flows around news events to spot redemption waves early. If a jurisdiction unveils tighter rules, expect spreads and fees to move. Diversification across issuers, rails, and venues is a simple but powerful cushion when policy risk spikes.

Position Sizing and Event Calendars

Map key policy dates: FSB reviews, FATF updates, and local rulemakings. Around those windows, reduce leverage, add staggered entries, and consider limit orders rather than market orders in thin books. The goal is not to predict outcomes but to control variance when headlines land. Over time, this discipline compounds.

Quick Answers Investors Are Asking Today

Investors have practical questions: Will rules converge? How long will it take? What does it mean for stablecoins? The honest answer is that convergence is likely but uneven, and the 2025 review shows we’re not there yet. Stablecoins remain central to market plumbing, so expect close scrutiny. In the meantime, align your tactics with high-quality venues and disclosures—and watch for jurisdictions that translate FSB guidance into binding law fastest.

Does This Kill Innovation?

Not necessarily. Clear rules lower cost of capital and encourage long-horizon building. Teams that front-run compliance often gain distribution advantages—faster banking, better listings, and stronger enterprise demand. Innovation slows when rules are uncertain, not when they are clear. The market is asking for predictability, and alignment delivers it.

Which Assets Are Most Exposed?

In general, assets relying on opaque stablecoin plumbing, unlicensed venues, or offshore liquidity face the most headline sensitivity. Large-cap assets with diversified rails and better compliance footprints tend to be more resilient to policy shocks, though not immune. Treat exposure as a spectrum, not a binary.

What Would Be a Bullish Policy Signal?

A major jurisdiction shipping comprehensive stablecoin law, plus live CASP licensing with standardized reporting, would cut policy risk premiums quickly. Watch for mutual recognition or data-sharing pacts across borders. Those are green lights that the market structure is maturing, not just rallying on sentiment.