What Is Pawthereum and Why Investors Love It

Discover Pawthereum (PAWTH), a crypto token merging blockchain innovation with animal charity. See why investors are turning to this unique ethical asset.

By Yaser | Published on October 25, 2025

From Grumpy to Pawthereum — How the Story Began

Pawthereum’s roots trace back to a community effort to revive and rebrand the abandoned Grumpy Finance idea into a transparent, charity-first token. The public launch as Pawthereum (PAWTH) happened on October 10, 2021, with a mission to route a portion of activity toward animal-welfare causes. Because the team wanted a clean start and a clear purpose, it framed the project as community-run and charity-focused from day one. Over time, Pawthereum highlighted real donations, documented partners, and kept an open door to animal shelters, which helped move the narrative from hype to impact.

The Official Vision and Early Roadmap

From the beginning, Pawthereum presented itself as a crypto philanthropy project that supports shelters and advocates for animals in need. The official site and whitepaper describe a community-run approach, where transparency and on-chain accountability matter. In practice, that meant publishing goals, listing partner shelters, and explaining how funds move. This clarity, although not perfect, built initial trust and gave investors a reason to watch beyond price action. The key idea was simple: use Web3 mechanics to fund real-world animal welfare, then report results in a visible way.

The Renaming and Legal Clean Break

The rebrand to Pawthereum also served to separate the project from earlier memes and IP risk around “Grumpy Cat.” Public summaries note that Pawthereum emerged as the community-owned continuation with a charity-first identity, distancing itself from prior branding challenges while keeping the shelter-support DNA. For investors, this matters because branding clarity reduces distraction and lets the team focus on operations and donations. The consistent messaging—animals first, crypto second—helped reframe PAWTH as more than a typical meme coin and positioned it within impact-driven crypto.

Why Launch Timing Mattered in 2021

Launching in late 2021 meant riding a wave of interest in Web3 + social impact, but also facing volatility. The team leaned into community updates and charity partners to remain relevant as markets cooled. Because impact stories resonate even in bear cycles, early donations and shelter collaborations kept Pawthereum visible when speculation faded. This strategic focus on real outcomes helped the brand weather downtrends better than hype-only tokens, and it gave content creators and charities reasons to engage regardless of price.

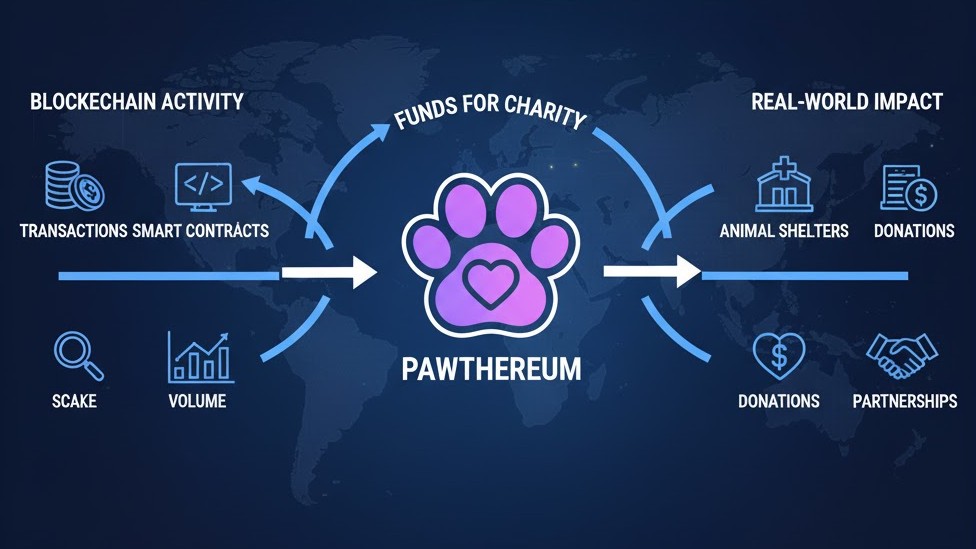

Mission and Mechanism — How PAWTH Turns Activity into Impact

Pawthereum describes itself as a community-run charity cryptocurrency. The mechanism is straightforward to understand: the project channels funds from token activity and community initiatives to animal shelters and welfare organizations. While token prices can fluctuate, charitable impact remains the anchor. Therefore, players, holders, and donors can evaluate the project on two parallel tracks: financial sustainability and measurable donation outcomes. This dual-track model is why the project emphasizes transparent comms, published partners, and public donation logs, letting supporters verify where funds go and how they help.

The Charity Flow in Plain English

Here’s the simple loop: supporters engage with the token or campaign, the project allocates a charity portion, and vetted nonprofits receive funds or crypto assets. Then, the project shares receipts, updates, or partner posts to close the loop. Because credibility is the foundation, Pawthereum partners with known platforms and organizations where possible and highlights specific shelters by name. This structure makes it easier for newcomers to verify the story and for shelters to confirm receipt publicly, creating a repeatable pattern of trust.

Partnerships and Platforms that Add Credibility

To make giving easier, Pawthereum has appeared in donation-focused platforms and charity pages that accept crypto and explain the impact. For example, The Giving Block profiled Pawthereum’s approach and cited hundreds of thousands of dollars in cumulative donations. Individual animal charities have also credited Pawthereum for prompting or facilitating their crypto donation programs, which shows the network effect of education plus funding. These third-party touchpoints help investors and donors cross-check claims.

Why Community Governance Matters

Because community funds and reputations are at stake, governance and clear proposals matter. In practice, this means publishing plans, explaining priorities, and inviting holders to review what comes next. Over time, the project’s visibility depends less on speculative cycles and more on consistent delivery—proposals, audits, donation breakdowns, and partner confirmations. When these governance habits become standard operating procedure, trust compounds, and outreach to major nonprofits becomes easier.

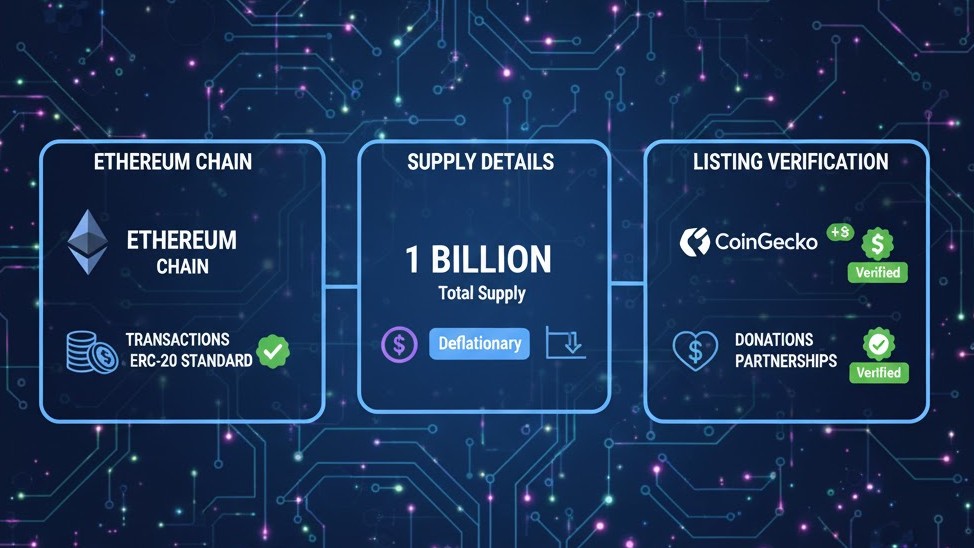

Token Basics — Chain, Supply, Listings, and Data Hygiene

Pawthereum launched in 2021 with a max supply of 1,000,000,000 PAWTH and runs on Ethereum (with project materials also referencing multichain and infrastructure evolutions over time). Public trackers list current pricing and market references, but data quality can vary by aggregator, so investors should cross-check contract addresses, migration notes, and listing details before any action. Because small-cap tokens often face liquidity and data quirks, maintaining a checklist—verify contract, verify exchange, verify bridge—is essential to avoid mix-ups with similarly named assets (e.g., unrelated “PAW” tokens).

Contract and Migration Notes

Over time, projects may migrate contracts or publish updated addresses, and explorers like Etherscan typically mark “old” contracts when a migration occurs. Before interacting, always confirm the official address on Pawthereum’s website or whitepaper, then validate on Etherscan. This protects you from copycat tokens and stale contracts. If any migration is referenced on explorers, read those banners carefully and follow official links rather than third-party posts or ads near the page.

Price Trackers and Their Limitations

Aggregators like CoinMarketCap and Coinbase price pages are useful, but they can lag or mislabel supply data for niche tokens. Treat them as directional, not definitive. Always reconcile with official channels before making decisions, and check multiple trackers if numbers look odd. If one site shows zero volume or missing circulating supply, cross-check elsewhere and look for project announcements. Data hygiene prevents common errors and reduces the risk of acting on incomplete snapshots.

Avoiding Token Name Confusion

The crypto space is full of similar tickers—for instance, “PAW” or “wPAW” on unrelated contracts and sites. Never assume a ticker equals a project. Match the full name + contract and confirm via official links. If you see a “PAW” token with a different website or ecosystem, it likely is not Pawthereum (PAWTH). This one habit blocks many scams and prevents accidental purchases of unrelated assets on DEXs or minor exchanges.

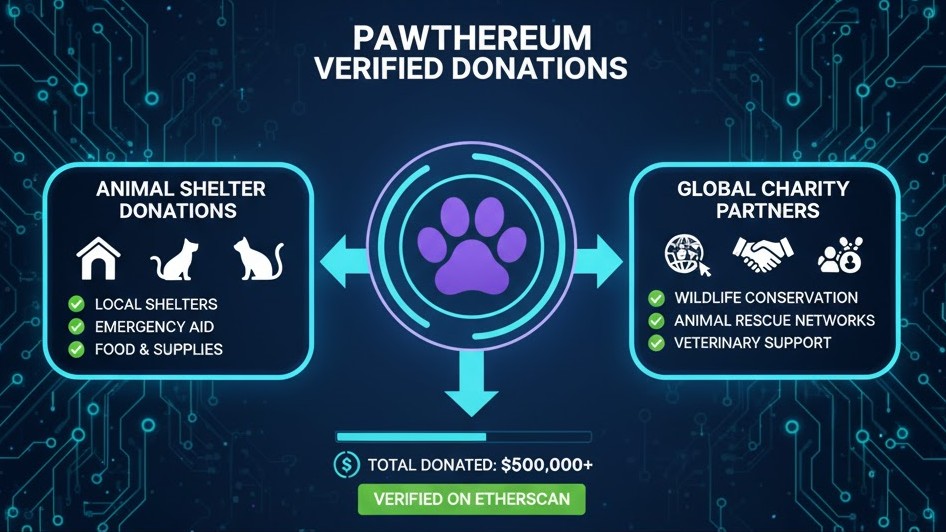

Impact So Far — Documented Donations and Notable Partners

What truly differentiates Pawthereum is documented impact. Public reports and charity pages show six-figure donations to recognized organizations, including Edinburgh Dog and Cat Home and Four Paws USA. Coverage from local and national outlets highlighted large crypto gifts, sometimes the biggest of their kind in a region at that time. Third-party interviews and Q&As also cite cumulative totals in the $475k–$500k range across supported causes. These numbers matter because they anchor claims in real-world outcomes that shelters can confirm and celebrate.

Examples of High-Profile Donations

In November 2021, Edinburgh Dog and Cat Home reported a crypto donation valued around £87,000 / $120,000, which local media called the largest known crypto donation to a Scottish animal charity at the time. This type of headline creates durable legitimacy, because it comes from the recipient and independent journalists. For newcomers, such articles provide a reliable, time-stamped checkpoint on Pawthereum’s real-world footprint and influence.

Partner-Led Validation

Beyond press, charity partners have hosted pages crediting Pawthereum for helping onboard crypto donations. When shelters publicly discuss how they received funds or why they embraced crypto, it reduces uncertainty for donors who want receipts and specifics. Because many nonprofits are cautious with digital assets, these confirmations act like quality signals that lower the trust barrier and invite more collaboration.

Why Transparent Logs Help Investors Too

Donation logs and press pages serve both donors and token holders. Donors see where money goes; investors see that community promises result in measurable action. This alignment of incentives—impact for shelters and accountability for token holders—can make a mission-driven token more resilient than hype-only projects. It also gives content creators material for ongoing updates that are independent of market cycles.

Latest Developments in 2025 — The “Big Beautiful Proposal”

In August 2025, Pawthereum published a “Big Beautiful Proposal” outlining priorities ahead of a March 2026 review vote. The plan emphasizes a Charity Impact Relaunch and other focus areas intended to increase transparency, structure, and community accountability. For readers of GrindToCash, this is the most recent forward-looking roadmap we can cite directly from the project, and it signals continued activity and planning rather than dormancy. As always, verify details on the official blog and compare any roadmap with delivery milestones as they roll out.

What the Roadmap Signals

A roadmap that names charity impact as a first priority suggests the team wants to double down on measurable outcomes. That means clearer reporting, refreshed partnerships, and possibly new donation formats or campaigns. For holders and supporters, this creates a checklist: track whether the team launches the relaunch, how often updates arrive, and whether shelters confirm receipt. Over the next two quarters, those signals will tell you if momentum is building.

Timelines and Review Points

Because the document references a review vote by March 2026, community members can plan their own expectations. This timebox is useful; it encourages progress checks and reduces vague “soon™” promises. If the team reports monthly or quarterly, supporters can evaluate traction, spot bottlenecks early, and offer help. In a mission token, predictable cadence often matters as much as technical upgrades.

How to Track “Real” Progress

To track progress, save the proposal link, follow the project’s blog/press pages, and watch for charity confirmations. Combine that with basic on-chain checks for treasury movements when available, and look for cross-posts by recipient organizations. If all three align—proposal → action → third-party confirmation—confidence rises. If not, ask questions in public channels and wait for clarity before taking risk.

Market Reality — Liquidity, Volatility, and Data Checks

Small-cap, mission-driven tokens can be volatile and illiquid. Pricing and volume can vary across aggregators, and sometimes circulating-supply fields are missing or lagging. Therefore, treat price pages as estimates and always verify on official channels before any trade. Because slippage and fees matter more in low-liquidity environments, consider limit orders where available, and avoid thin books that can move on small orders. Most importantly, separate the charity story from investment risk; impact is real, but prices still move with market sentiment.

Practical Liquidity Tips

Start with small test orders, watch the order book, and verify the contract address twice. If spreads are wide, avoid market orders that can fill at unexpected prices. Some exchanges may list outdated pairs or stale tickers; if something looks off—no volume, unverified contract—pause and re-check on the official site or whitepaper. This slow, careful approach prevents most common mistakes in niche assets.

Volatility and Position Sizing

Because volatility cuts both ways, decide your position size before you buy. With community tokens, a news burst can spike prices; equally, quiet weeks can drift lower. Instead of guessing tops or bottoms, consider dollar-cost averaging small amounts if you’re intent on exposure, and keep a clear exit plan. Remember: charity impact ≠ price stability. Protect your capital and your peace of mind.

Why Independent Sources Matter

Cross-check claims using press articles, charity posts, and third-party interviews. When multiple independent sources confirm donations and partnerships, you can trust the impact story more. Likewise, when multiple trackers align on contract and price, your trading decisions become safer. This multi-source habit is your best defense in fast-moving markets with mixed data quality.

Due Diligence — Steps You Can Follow Today

Before engaging with PAWTH, run a simple DD checklist. First, read the official site and whitepaper to understand the mission and mechanics. Second, confirm the current contract on Etherscan via official links, especially if you see “migration” notes. Third, verify that recent blog posts and proposals are active, not abandoned. Finally, look for shelter confirmations or platform profiles that validate impact. If these pieces line up, your risk of confusion drops, and your confidence in the project’s real-world value improves.

Reading the Whitepaper Efficiently

Focus on: mission, token utility, allocation, and governance. Skip jargon; look for specifics like supply caps, treasury rules, and donation pathways. If the document leaves important questions unanswered, search the press page or community posts. Clear, consistent answers across docs suggest a more organized team and fewer surprises later.

Verifying Contracts and Addresses

Open the official site, copy the contract address, and paste it into Etherscan. Check for any migration banners or “old contract” labels. If a DEX or exchange shows a different address, do not proceed until you reconcile the difference. Always assume copycats exist, and treat verification as a non-negotiable step.

Confirming Impact with Third Parties

Look for charities that mention Pawthereum by name on their own domains, and for platforms like The Giving Block that profile the project and tally donations. Screenshots are fine, but live links on the partner’s site are better. A few minutes of cross-checking can save you from relying solely on internal marketing claims.

Risks, Disclaimers, and Smart Participation

While Pawthereum’s mission is compelling, all crypto assets carry market and operational risk. Prices can swing sharply, and small-cap liquidity can dry up fast. Additionally, charity-driven tokens must balance funding with sustainable tokenomics; otherwise, long-term holders may feel pressure. That’s why we separate impact appreciation from investment decisions. On GrindToCash, we recommend you approach with caution, verify every step, and only participate with funds you can afford to risk. This way, you support good causes without compromising your financial safety.

Scams and Impersonation

Mission tokens attract impersonators who copy logos or set up fake socials. Always begin from the official site and follow links outward. If a Telegram or X account posts a “new contract” that isn’t on the site, assume it’s fake until proven otherwise. Bookmark the correct URLs and use them every time to avoid traps.

Regulatory and Tax Considerations

Donations and token trades may have tax implications depending on your country. Keep records of dates, amounts, and recipients. If you donate crypto directly, check if the charity can issue a receipt and whether your jurisdiction allows deductions. Because rules evolve, consult a local professional as needed to stay compliant and avoid surprises at filing time.

Managing Expectations Over Time

Impact tokens often move in seasons: bursts of news, then building phases. To stay sane, set realistic expectations. Follow the 2025 proposal milestones, watch for charity updates, and measure progress over months—not days. This approach lowers stress and keeps you focused on what matters: transparent action and real-world outcomes.