G7 Banks Plan New Stablecoins to Transform Digital Finance

Top global banks join forces to launch G7-backed stablecoins in 2025, reshaping digital payments, cross-border transfers, and the future of regulated crypto.

By Yaser | Published on October 24, 2025

What’s Actually Happening—and Why It’s Different

A consortium of ten major global banks is exploring stablecoins pegged to G7 currencies—USD, EUR, JPY, GBP, CAD, CHF, and potentially others. Unlike previous private experiments, this effort is bank-led, aims for public blockchains, and explicitly prioritizes compliance, risk, and interoperability from day one. If executed, it could shift stablecoins from crypto-native rails into the traditional banking stack, bringing deeper liquidity, stronger KYC/AML, and institutional-grade settlement. For traders and builders, that means fresh payment rails, new liquidity venues, and demand that is not purely speculative.

Who’s involved—and why it matters

Reporting lists big names like Bank of America, Citi, Deutsche Bank, Goldman Sachs, UBS, Barclays, TD, Santander, MUFG, and BNP Paribas. A bank cohort of this caliber can mobilize compliance teams, enterprise clients, and treasury operations—accelerating adoption far beyond retail-only use cases. As a result, the conversation shifts from “if” to “how” banks deploy tokenized money.

Public chains, not closed gardens

Early information indicates exploration on public blockchains rather than proprietary ledgers. That choice matters: public rails enable composability with wallets, on-chain analytics, and existing DeFi/FinTech apps—while still allowing bank-grade controls via permissioned layers and compliance oracles.

Why now? (policy + market pressure)

Stablecoin volumes, regulatory clarity, and competitive pressure from fintechs have pushed banks to move. Recent analysis also argues that stablecoins can increase global dollar demand, aligning incentives for USD-centric institutions to participate—legally and at scale.

What Bank-Grade Stablecoins Could Unlock

Bank-issued stablecoins could transform cross-border payments, wholesale settlement, and on-chain FX. Because banks already manage KYC/AML and correspondent networks, their tokens can plug into existing client flows with minimal friction. Moreover, multi-currency issuance (G7 basket) enables real-time, on-chain FX pairs with deep bank liquidity, reducing spreads and settlement risk. The upshot: fewer hops, faster finality, lower fees—and programmable money that fits into audit trails, accounting systems, and regulatory reporting. That’s the missing bridge between crypto speed and bank compliance.

Cross-border payments without the “multiple intermediaries” tax

Today’s wires cross several banks and cut-off times. Tokenized bank money can enable T+0 settlement, 24/7, with atomic swaps and clear on-chain proofs. For exporters, treasurers, and exchanges, that’s not hype; it’s a working capital upgrade.

On-chain FX with G7 pairs

If banks issue multiple fiat-pegged tokens, EUR/USD, USD/JPY, GBP/USD, etc. can trade on-chain with bank-provided depth. Transparent order books plus auditable reserves reduce the “black box” fear that dogs non-bank stablecoins.

Programmable cash for enterprises

Invoices, escrow, and milestone payments can run on smart contracts using bank-money tokens. CFOs gain instant reconciliation, while auditors get deterministic logs—no more PDF chasing. This is where real enterprise adoption begins.

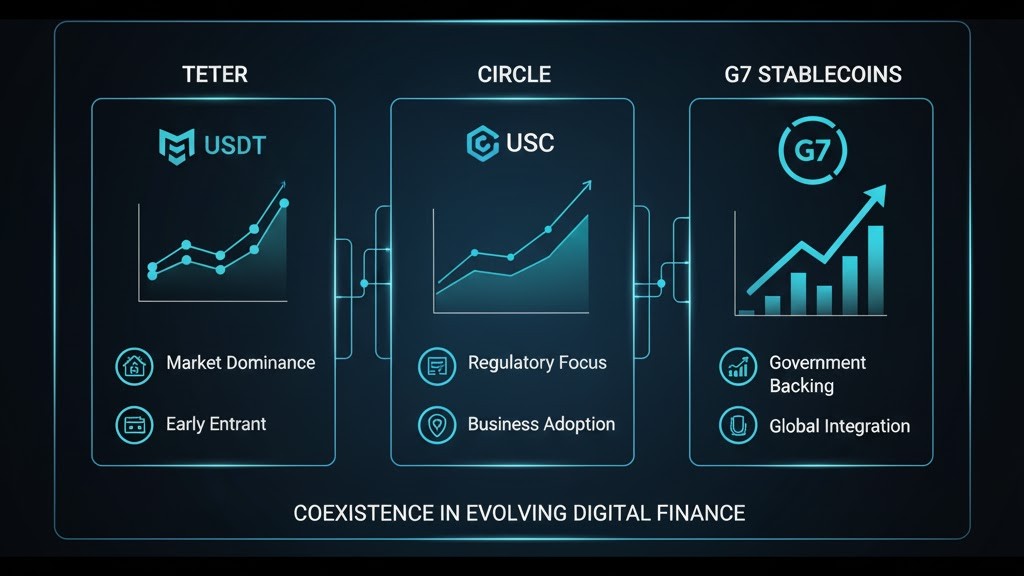

How This Plays with Today’s Stablecoin Leaders

Tether and Circle dominate current stablecoin usage, primarily within crypto markets. Bank tokens won’t replace them overnight; instead, they’ll expand the total addressable market by servicing regulated B2B payments, FX, and embedded finance. Importantly, the banks’ move validates the tokenized-money model and could normalize on-chain settlement for conservative institutions. Expect coexistence: crypto-native stablecoins remain agile and ubiquitous; bank-issued tokens win regulated flows where counterparty risk and policy alignment rule the day.

Liquidity fragmentation—and why that’s okay

Multiple issuers mean multiple pools. But cross-chain bridges and institutional venues can aggregate depth. In practice, competition improves pricing and resilience, provided reserves and disclosures are robust.

Disclosure: the banks’ likely edge

Banks already live under strict reporting. If they publish real-time reserve attestations and standardized audits, they’ll attract corporates that avoided opaque issuers. Transparency becomes a competitive moat.

Where crypto-native issuers still win

Retail UX, global wallet support, and DeFi composability are hard to beat. Many users will keep using USDT/USDC for convenience—while enterprises adopt bank tokens for compliance-sensitive flows. Both can grow.

The Macro Angle: Dollar Demand, Bank Deposits, and EM Risks

JPMorgan estimates stablecoins could add $1.4 trillion in extra USD demand by 2027 if adoption accelerates—especially overseas. That’s bullish for dollar liquidity, but there’s another side: studies warn of deposit outflows from emerging-market banks as users prefer dollar-stable tokens, potentially up to $1 trillion in a few years. Bank-issued tokens might amplify both effects by lowering friction even further. Policymakers will watch this closely, balancing innovation against financial-stability risks.

Who gains from a bigger dollar footprint

Exporters, remitters, and dollarized economies benefit from cheaper, instant USD rails. The more bank-grade options exist, the more corporates adopt on-chain dollars for settlement and hedging.

Who may face pressure

Some EM banks could see faster deposit flight during stress events as users rotate into on-chain dollars. Expect central banks to respond with tokenized domestic money or tighter rules to keep liquidity at home.

Why multi-currency matters

A G7 basket doesn’t just boost the dollar; it can rebalance FX choice. If EUR, JPY, or GBP stablecoins have credible bank backing, cross-border commerce can diversify away from USD when it makes economic sense.

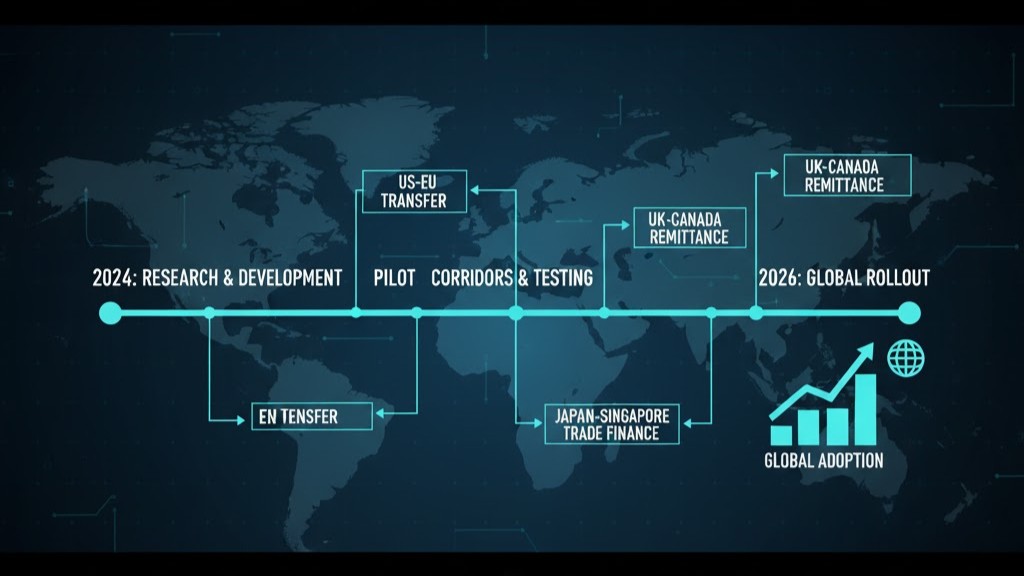

What to Expect Next: Pilots, Rails, and Where You’ll See It First

Early phases typically look like limited pilots with selected clients: corporate treasuries, fintech partners, and cross-border corridors. You’ll see wholesale settlement use cases, programmable escrow, and invoice financing experiments. Then, as confidence grows, banks integrate the tokens into treasury portals and merchant services, and list them at institutional venues. Watch for public test transactions, published attestations, and bank API docs—these are signs the rails are real, not PR.

Likely technical stack

Expect EVM-compatible chains for tooling maturity, plus bank-controlled permission layers for compliance. Oracles will feed FX rates and sanctions data; custody integrates with bank-grade HSMs and ledgering systems.

First corridors to watch

U.S.–EU, U.S.–UK, and EU–Japan are natural starts given volumes and regulation. Over time, corridors expand where banks already have strong correspondent relationships.

Data you should track

Monitor on-chain supply, reserve disclosures, settlement volumes, and FX spreads. Rising real-economy throughput—not just exchange transfers—signals true adoption.

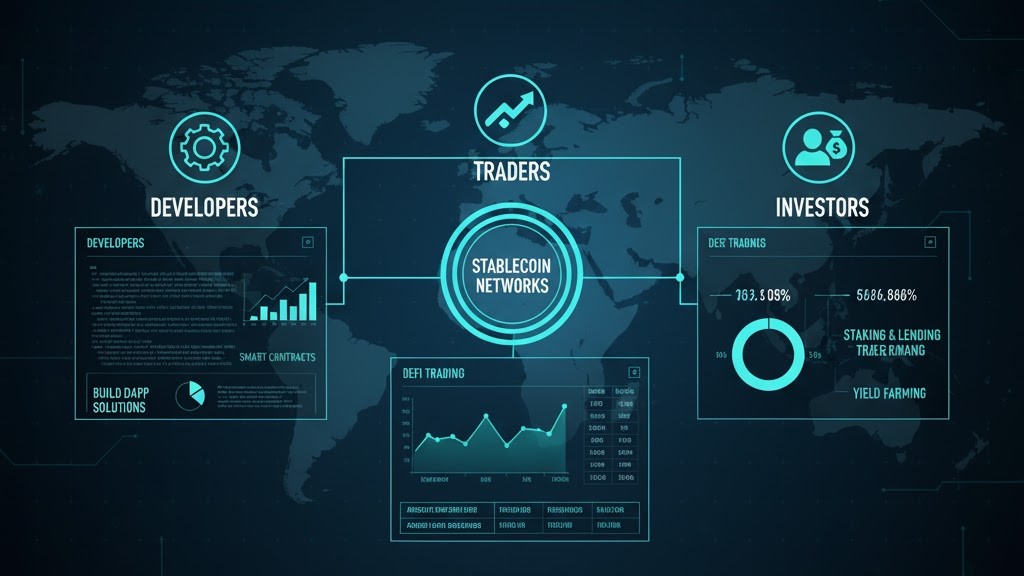

Opportunities for Builders, Traders, and Long-Term Holders

For builders, bank tokens unlock compliant embedded-finance apps: payables automation, programmable payroll, and cross-border subscriptions. For traders, multi-currency stablecoin pairs create on-chain FX strategies and carry trades bounded by bank disclosures. For long-term holders, the thesis is broader: tokenized money is becoming a bank product, and the applications layer will monetize the rails—payments, lending, and structured products—over the next cycle. Align your strategy with measurable throughput and bank-published metrics.

Builder playbook

Start with B2B workflows where compliance is mandatory: vendor payments, escrow, and settlement APIs. Wins here compound because enterprises scale by policy, not hype.

Trader edge

Track issuance calendars, attestation dates, and corridor launches. FX spreads tighten around disclosures and widen when information is scarce—alpha lives in that timing.

Investor thesis

Pick platforms that publish transparent, third-party-verified reserves and show real client adoption. A token without enterprise flow is just a ticker.

Risks: Fragmentation, Compliance Friction, and Tech Debt

Even with banks involved, risk doesn’t vanish. Liquidity fragmentation across chains and issuers can complicate routing. Compliance rules may diverge across jurisdictions, creating patchy access. And tech debt—from clunky core systems to brittle bridges—can slow rollouts. Moreover, regulators may tighten rules if deposit flight or FX instability appears. To manage this, diversify venues, prefer tokens with clear legal opinions, and avoid over-reliance on a single corridor or issuer in your operations.

Fragmentation play

Use aggregators and institutional venues that pool liquidity across chains. Choose counterparties publishing unified APIs and audit trails to simplify ops.

Compliance creep

Rules can change abruptly. Maintain KYC/KYB hygiene, refresh sanctions lists, and watch for cross-border reporting updates tied to on-chain money flows.

Technical soundness

Favor issuers with hardened custody, incident-response plans, and transparent status pages. In tokenized cash, operational resilience is strategy.

Actionable Checklist: How to Prepare Right Now

To turn this news into results, follow a simple checklist. First, set up monitoring for issuer announcements and reserve attestations. Second, map your likely corridors and counterparties, then model savings vs. wires. Third, test a small pilot: pay a vendor or settle a trade using a bank-issued token as soon as a corridor opens. Fourth, document policies: wallet controls, accounting treatment, and reconciliation steps. Finally, review outcomes monthly and scale deliberately. This is how you convert headlines into durable, compliant advantages for your business.

Set your data dashboard

Track supply, volumes, attestation timestamps, and live FX spreads. Tie metrics to decisions—don’t fly by headlines.

Run a corridor pilot

Pick one high-volume route and a willing partner. Define KPIs: settlement time, fees saved, error rates. Measure, iterate, repeat.

Governance and accounting

Align your policies with auditor expectations early: chart of accounts for tokenized cash, cutoff procedures, and documentation for every movement.