The Complete Render Token Growth & Analysis in 2025

Render (RNDR) started as a bold idea: use spare GPU power around the world to render 3D graphics, VFX and, recently, AI workloads — and reward contributors with a token. Today RNDR sits at the intersection of media, AI compute and blockchain. This guide traces Render’s journey, technical changes, real-world use cases, token mechanics and the latest developments that matter for investors and creators.

By Yaser | Published on October 19, 2025

Origins and Early Development (whitepaper, early team, first launches)

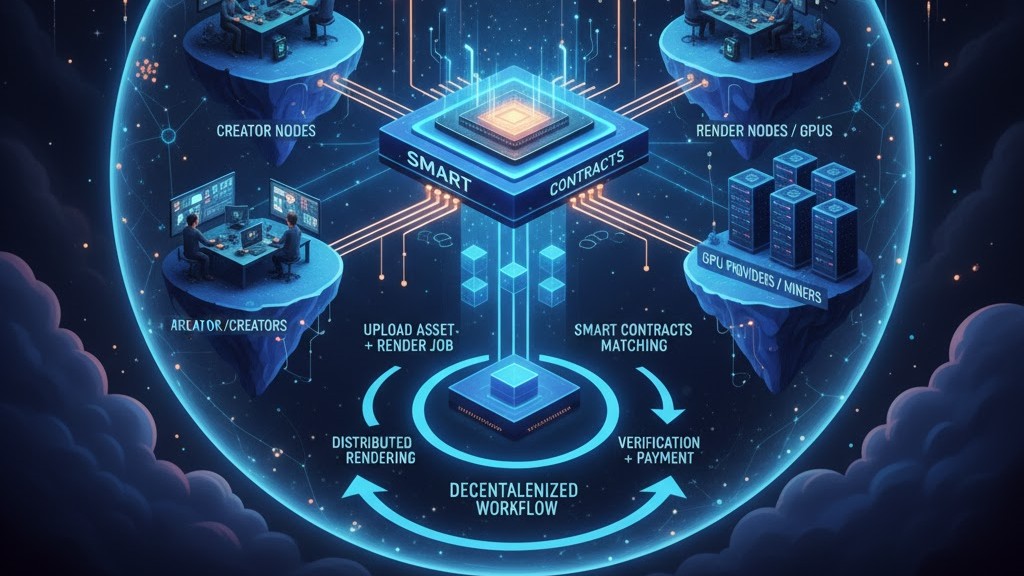

Render’s story begins with a simple problem: rendering high-quality 3D images and animations is expensive and slow on single machines. The Render concept originated inside OTOY and the team published early technical plans and a whitepaper in 2017 describing a decentralized GPU network for rendering jobs. The idea was to let artists and studios submit render jobs, let node operators process them using idle GPU cycles, and settle payments using a native token (RNDR). In the early years the project focused on proving the basic marketplace, building integrations with common render engines, and attracting node operators. Those foundational steps set the stage for later scaling and for adding features that target bigger customers in media and AI.

Founding team and mission

The project grew from OTOY’s research in rendering. The team’s mission was practical: reduce cost and latency for rendering, while creating a tokenized economy where GPU owners earn rewards. Because the team had deep domain knowledge in graphics and production workflows, early adopters were mostly digital artists and VFX houses who needed cheaper render capacity.

Early product and testnet phases

Initial releases focused on a reliable job submission flow and reputation for node operators. The roadmap emphasized stable job processing and guardrails to maintain quality. These early testnet and beta phases were crucial: they validated that real production workloads could be distributed to a global set of machines without breaking artist workflows.

First user stories and case studies

From the start, the project highlighted user stories: freelance artists finishing a client render faster, or small studios completing sequences they otherwise couldn’t afford. Those early wins created word-of-mouth traction and gave the team the confidence to move toward wider public launches and token distribution events.

Token Launch, Economics and Key Protocol Changes

Render’s tokenomics evolved across years. The RNDR token was distributed via early sales and allocations, and the protocol defined how payments flowed from requesters to node operators. Over time, the team refined emission rules and governance elements to align incentives for creators, node operators and token holders. Notably, in later cycles the project introduced mechanisms like buybacks or token flows designed to support on-platform usage and onboarding. These economic tweaks were not cosmetic; they aimed to maintain a healthy balance between supply, demand and utility usage as network activity scaled.

Basic utility: paying for rendering work

At its core RNDR is a utility token: users pay with RNDR for GPU compute to complete render jobs. That simplicity kept the early UX straightforward, and it tied token demand directly to real economic activity — a key point for long-term token value if the network saw ongoing usage.

Emission management and buyback programs

To support onboarding, the team has used token flows and market operations to smooth supply. For example, announced buyback operations or token purchases for redistribution help bootstrap usage credits for new creators. These programs aim to lower friction for newcomers while managing token supply dynamics.

Migration and technical pivots (fees, chains)

As demand and use cases expanded, Render adjusted technical choices — including approaches to reduce fees and increase throughput. Strategic migrations or integrations with other chains and tools were part of this evolution, with the goal of lowering cost for users and opening broader developer ecosystems.

Product Evolution: From 3D Rendering to AI & Compute Workloads

Render started squarely in 3D rendering, but as generative AI and large-scale model inference grew, the network extended into AI workloads. The architecture that scheduled GPU jobs for rendering also fits inference and some training tasks. In 2025 Render publicly trialed and expanded compute services aimed at AI inference, and the roadmap signaled broader ambition: serve both media pipelines and AI customers who need bursty, GPU-heavy compute without vendor lock-in. This shift is meaningful: it increases the total addressable market from artists and VFX to developers and enterprises using ML models.

Why GPU compute for AI matters to Render

AI workloads — especially inference and generative models — demand huge GPU capacity. Render’s decentralized model can offer cost advantages and geographical diversity for inference. That makes the network attractive to labs and companies seeking alternatives to centralized cloud providers.

Product changes to support inference and AI APIs

To support AI use cases, Render added API endpoints and tooling that match ML workflows: batch inference, model hosting, and lower-latency RPC endpoints. These product upgrades bring new technical requirements (latency SLAs, model versioning, security) that the team prioritized as adoption grew.

Customer types: artists, studios, and ML teams

The network now targets a broader customer mix. Artists still use Render for final frame rendering and VFX; ML teams can use the platform for inference tasks or to augment cloud capacity. This diversified demand can stabilize long-term revenue and token utility if adoption continues.

Strategic Partnerships, Conferences and Market Positioning

Render has consistently pursued visibility through events and partnerships. In 2025 the team hosted RenderCon, a high-profile industry event that gathered creators, investors and tech leaders to discuss the future of media, AI and compute. Public events like this boost credibility in creative industries and signal a move toward mainstream recognition. At the same time, news stories reported partnerships and increased cooperation with major compute and GPU ecosystems, which helped push RNDR into conversations about decentralized AI infrastructure.

RenderCon and industry outreach

RenderCon 2025 was presented as a bridge between Hollywood creative talent and compute infrastructure providers. Events like this accelerate real partnership opportunities (studios, ad houses, tools vendors) and help platform adoption in production pipelines.

Partnerships with GPU and infrastructure vendors

Media coverage has referenced collaborations and deeper technical ties with GPU ecosystem participants. These alignments help ensure node operators can supply reputable hardware (for example NVIDIA GPUs) and that the platform can support production SLAs.

Positioning against centralized clouds

Render positions itself as a complementary alternative to centralized cloud GPU providers. The pitch: decentralized nodes reduce vendor dependence, offer competitive pricing, and open a marketplace for spare GPU cycles — appealing to cost-conscious studios and new AI projects.

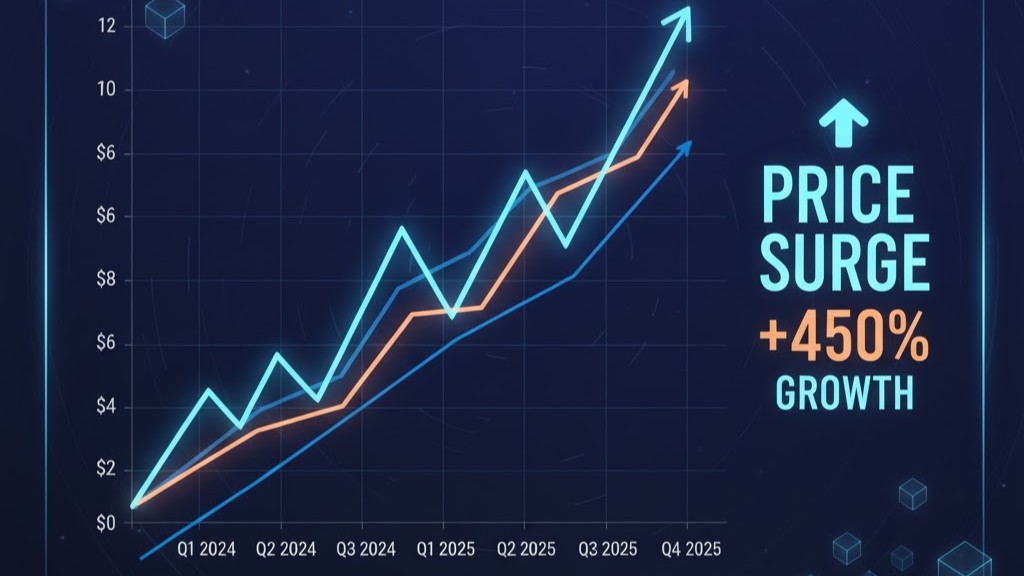

Token Performance, Market Data and Recent Metrics

RNDR’s market profile changed markedly into 2024–2025. Market data shows RNDR climbed from earlier lows to much higher valuations as adoption signals and AI interest grew. By late 2025 RNDR’s circulating supply metrics and market cap placed it among the mid-cap crypto projects, and price forecasts and analyst notes began to reflect both speculative momentum and real utility. That said, price volatility remains typical for altcoins, and trading volumes spike around news events or major product announcements. Use market metrics as a guide — not a guarantee.

Key on-chain and off-chain metrics to watch

Watch circulating supply, burn/buyback announcements, exchange flows, and on-chain job volumes. These signals show whether tokens are being consumed for compute or simply traded. High job volume and token burns are bullish for utility; large exchange outflows can indicate long-term holder accumulation.

Recent price action and analyst voices

Analysts in mid-2025 published bullish price scenarios tied to AI compute demand and strategic integrations. Price targets vary, but many forecasts assumed adoption ramps and tighter tokenomics as catalysts. Always consider multiple models and stress tests, since forecasts can diverge widely.

Liquidity, listings and accessibility for traders

RNDR is listed on major exchanges and has sufficient liquidity for most retail trades. Still, institutional-sized trades require OTC or deeper order book management. Accessibility across centralized exchanges and DeFi markets helps retail access, but institutional adoption depends on custody, compliance and fiat rails.

Recent Milestones: 2025 Announcements, Trials and Roadmap Moves

In 2025 Render announced and ran several initiatives: a public RenderCon event, trials of AI inference compute, on-chain token programs and targeted token operations to support onboarding. The project also signaled expansion of node operator recruitment (including U.S. operators with modern GPUs) and product pilots for enterprise inference use. Those updates pushed RNDR into a new narrative: not only a creative rendering tool, but a decentralized compute layer for AI and media. If pilots convert into paying customers, that’s a material growth path; otherwise, RNDR must continue to show product-market fit for each vertical it targets.

Token buyback or redistribution programs

Specific token fund operations were used to support onboarding, with planned purchases and redemptions announced to facilitate credits for creators. These programs lower initial barriers for creators to try the network.

Expand node operator base and geographic diversity

Expanding node operators, particularly in regulated markets, helps lower latency and increase trust for enterprise clients. The roadmap emphasized onboarding professional node operators with vetted GPUs and operational standards.

Pilot programs for enterprise customers

Pilot projects with studios or AI groups test the economics of decentralized compute. Successful pilots lead to contracts and steady demand; failure means further product iteration. The 2025 pilots aim to prove cost and performance vs. centralized clouds.

Risks, Regulatory & Competitive Landscape

Render faces the same structural risks as other infra tokens: technical risk, competition from centralized cloud providers, regulatory uncertainty, and tokenomics execution. Regulatory regimes differ across jurisdictions — what is permitted in one market may be restricted in another. Competition is intense: large cloud providers and specialized GPU farms can undercut prices or offer turnkey enterprise contracts. Additionally, running a distributed compute network requires robust security, anti-fraud measures, and strong SLAs. For investors, these risks translate into potential volatility and execution risk; for creators, they mean careful vendor selection.

Technical and execution risks

Scaling distributed compute reliably is hard. Node heterogeneity, network latency, and job integrity checks are ongoing engineering challenges. A single high-severity failure can harm reputation and adoption.

Regulatory and compliance friction

Working with enterprise customers in regulated markets requires compliance, data controls and sometimes local compute restrictions. Render must build compliance capabilities to serve some enterprise segments.

Competitive threats from cloud providers and other chains

Massive players (hyperscalers) and other decentralized projects target similar workloads. Render’s defensibility depends on cost, speed, integration ease and the ecosystem of partners.

What Investors and Creators Should Watch Next

If you follow RNDR, focus on measurable signs: (1) real job volume on the network and sustained growth in paid render and AI jobs; (2) partnerships with major studios, tool vendors or GPU providers that make node operator onboarding easier; (3) token operations that reduce friction for creators (buybacks, credits); (4) pilot results that prove cost parity or advantage vs. cloud. Also monitor macro trends: AI demand, GPU supply cycles, and regulatory news. These signals together tell whether RNDR is moving from experimental to mainstream utility.

Short-term watchlist (next 3–6 months)

Look for quarterly reports on job volume, announcements from RenderCon follow-ups, and any formal partnerships with large studios or AI firms. These are high-signal events.

Mid-term catalysts (6–18 months)

Adoption by enterprise customers, improved API tooling, and scalable node operator programs are mid-term catalysts. Tokenomics adjustments that increase on-platform token burn or utilization also matter.

Red flags to heed

Rapid token sales by insiders, failed pilots, or persistent job failures are red flags. Also watch legal or regulatory warnings in key markets. If red flags appear, reassess exposure and risk sizing.